Dealer Portal

Please email: hinodealerportal@toyotacf.com

Use CTRL+G on a PC or Command+G on a Mac to find the next instance of a word.

News and Updates

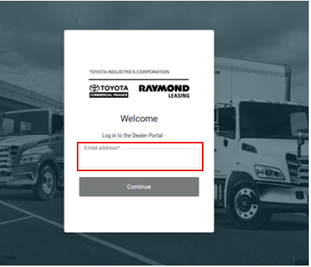

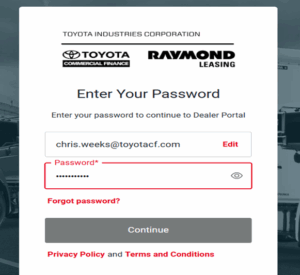

Account Login and Resetting Password

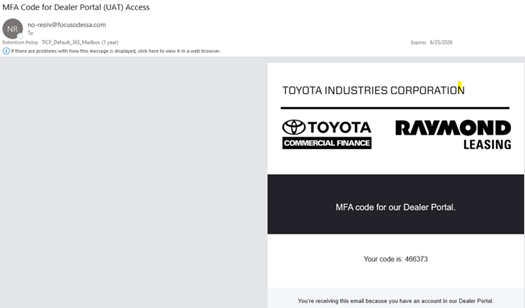

On successful creation of your profile, you would receive an email notification that would look something like this from Toyota Industries Corporation:

- To access the TICF Dealer Portal, use the URL provided in the email. Alternatively, you can also paste the provided URL in the browser.

Note: The Dealer Portal can be accessed across Google Chrome, Microsoft Edge, Mozilla, Firefox, and Safari. - To log in for the first time, use the Login Credentials mentioned in the email.

- Check I agree to the Terms & Conditions and click Sign In. Since this is your first login, you will be redirected to set a new password for your account.

- Enter the password mentioned in the email as Temporary Password followed by a New Password. Ensure that the password meets the requirements mentioned on the screen.

- To confirm the new password, re-enter the new password and click Next

- On setting your new password successfully, you will receive the success message. With the new password now set, you can log into the Partner Portal.

- Enter your username and the newly-set password.

- Check I agree to the Terms & Conditions and click SIGN IN.

Once you have logged in to the TICF Dealer Portal, a Multifactor Authentication Code will be sent to your email address to complete the login process.

You’ll receive an MFA Code for Dealer Portal Access for authentication. Enter the emailed MFA code and continue.

Reset Your Account Password

In case you forget your password and cannot sign in from the Login Page of the Partner Portal, you can choose to reset your password.

To reset the password for your account, perform the following steps:

1. On the Login page of the Partner Portal, click Forgot password?.

2. Enter your Username and Registered Email ID and click Next. This opens the Forgot Password window.

3. Click RESET PASSWORD.

4. You will receive the temporary password confirmation email.

5. Now, access the Partner Portal URL.

6. Enter your Username and the Temporary password mentioned in the email.

7. Next, select I agree to the Terms and Conditions checkbox.

8. Click Sign In. This opens the Reset Password window.

9. Enter the password mentioned in the email as Temporary Password followed by a New Password. Ensure that the new password meets the requirements mentioned on the screen.

10. To confirm the new password, re-enter the new password

11. Click RESET PASSWORD.

12. On resetting your password successfully, you will receive the confirmation success message.

13. Click LOGIN NOW and enter your Username and the newly-set Password.

14. Check I agree to the Terms & Conditions and click SIGN IN .

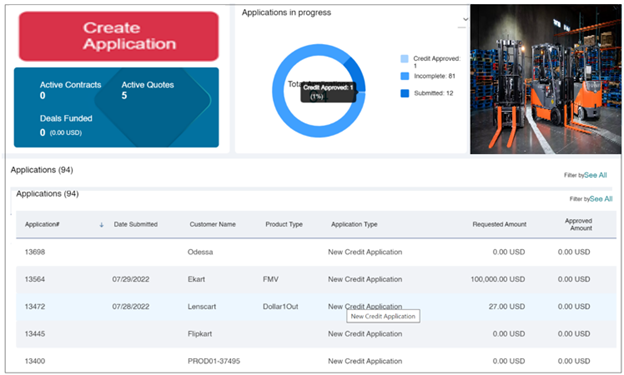

Dealer Portal Dashboard

The Dealer Portal Dashboard is an information management module that tracks, gathers, and displays data in interactive and customizable visualizations that enable users to monitor the processes, and provide them with actionable insights.

The Dealer Portal Dashboard module displays following details:

When you visit the Dashboard, you are greeted by a welcome message.

Create Applications

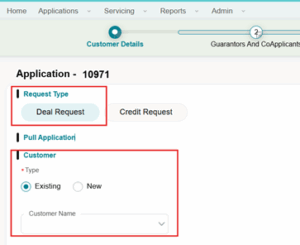

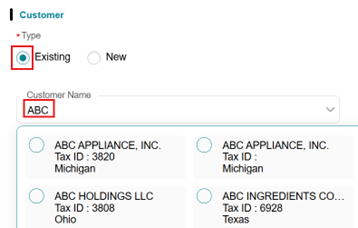

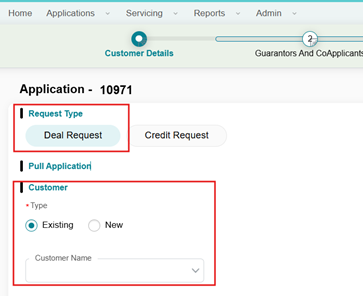

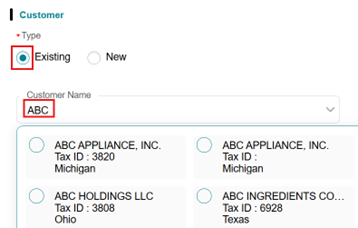

• Create Application: Click Create Application. Select Deal Request you will select a customer type, New or Existing, to proceed.

Note: The system will default to Existing Customer.

Selecting Credit App and Deal

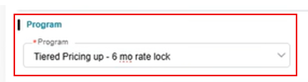

• Once “Deal Request” is selected and after entering customer information, Program will appear at the bottom left of the page.

• Select the appropriate Finance program, such as Tiered Pricing up – 6 mo. Rate lock, etc. You can only select one Finance Program per Application from the dropdown menu.

• If you have two different program types, they must be submitted separately on different applications.

Selecting an Existing Customer:

• Type the customer’s name; matching records from your portfolio will appear.

When searching for a customer, asterisks may be used as a wildcard. Example: ”*al “ for Allied Welding, INC.

• Select the desired customer name with the correct Tax ID. The last 4 of the ID will show

• Verify Existing Customer data.

• Customer Name and Tax ID change will require a Service Request.

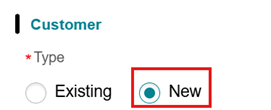

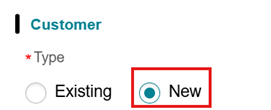

For a new customer select the New Customer button.

Steps to Create a New Customer:

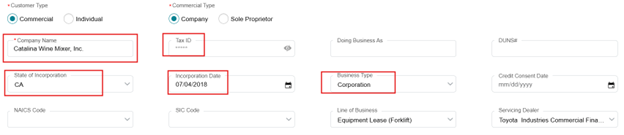

- Complete the required customer credit information fields.

- Fields marked with a red asterisk (*) are mandatory and must be filled out to proceed.

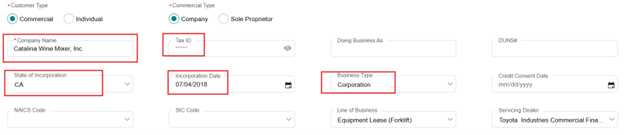

2. Enter the relevant customer information:

- For Individual this will commonly be used. Please do not use Sole Proprietor

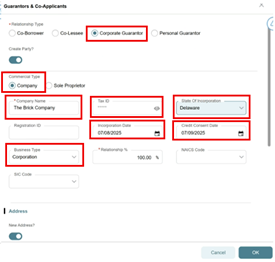

- For company, enter Legal business name, Tax ID, State of Incorporation and Business Type.

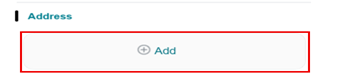

- The TAX ID Field will not be editable until the address is filled out.

- For individuals, you will be required to enter their full legal name, date of birth and SSN

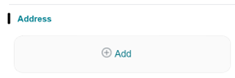

NOTES and TIPS: As designed you will need to ADD an address before you can enter the Tax ID.

Application In-Progress

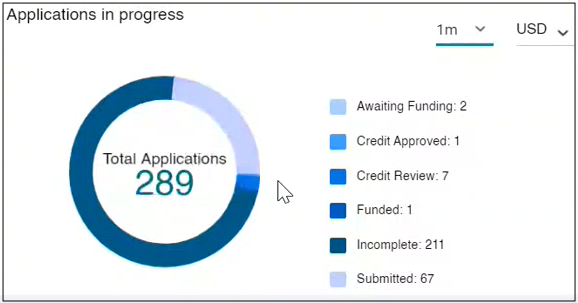

The adjacent section displays Applications in-progress details:

• Total Application: The chart displays total number of applications submitted.

• Application Status: The displayed statuses are Awaiting Funding, Credit Approved, Credit Review, Funded, Incomplete, and Submitted.

• Filters: There are two filters common with Application In-Progress. One is the Schedule filter. The data can be displayed on weekly or Monthly basis. Next to it is Currency filter. Currency filter comprises all the currencies associated with existing contracts. So if you choose CAD, all the contract with CAD are displayed here.

Note: The user can deselect filter anytime.

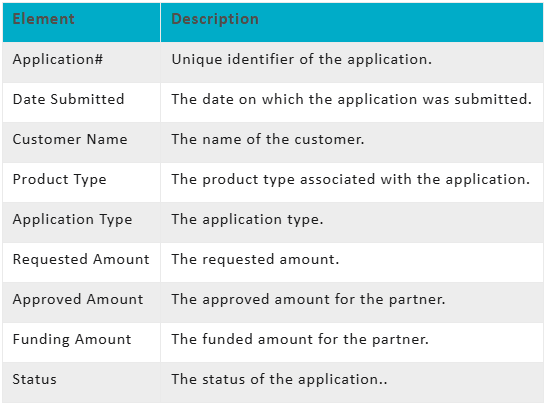

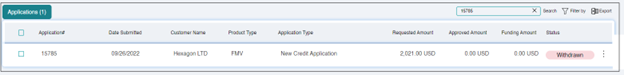

Application grid-view

The Application grid-view displays Application Number, Date Submitted, Customer Name, Product Type, Product Application Type, Requested amount, Approved Amount, Requested Amount, and Approved Status. Only top 5 applications are displayed in the grid-view. But the user can use Filters to view desired application details.

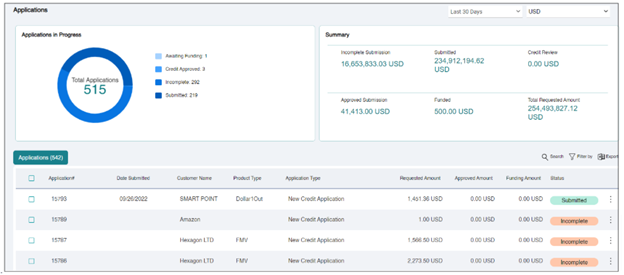

View Applications

The Dealer Portal allows you to view all your Total Applications and Summary in one single place. To access, navigate to Applications > View Applications from the main menu header. This opens the Applications tab that provides you with a list of applications that are applicable to you.

For each listed application, you can view the following information:

The Export option will export applications based on Search and Filter Criteria

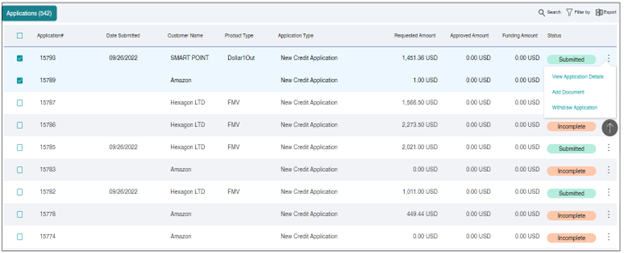

For active applications, there is a drop-down menu with options, View Application Details, and Add Documents.

Note: When exporting downloading data from Dealer Portal using export to XLS or Export to CSV (![]() ) an error may appear. See Helpful Hints to Access Microsoft Edge in the Dealer Training Center.

) an error may appear. See Helpful Hints to Access Microsoft Edge in the Dealer Training Center.

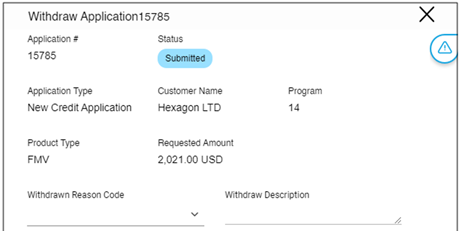

Withdrawing Application

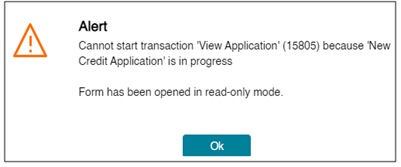

If required, an application can be withdrawn. When an end-user clicks Withdraw Application, then as per set validations, the system displays a validation if the application falls under following categories:

• The application cannot be withdrawn if one or more contracts associated with the application are funded or commenced.

• The application cannot be withdrawn if the New Credit Application is in progress mode.

• The application cannot be withdrawn if it is in any of the following Statuses in Lessor Portal: Inactive, Withdrawn, Approved Not Accepted/Declined All Lines or Completed

If the application does not fall under any validation category, then follow the steps below to withdraw an application:

1. Click Withdraw Application from Home Screen then click on the three dots edit to the right of the application, use the drop-down list. This action opens Withdraw

Application window.

2. Select the Withdraw Reason Code from the drop-down list followed by entering Withdraw Description.

3. Click Withdraw Application

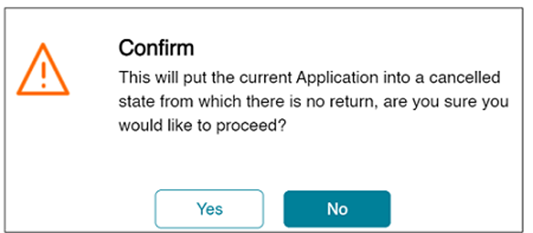

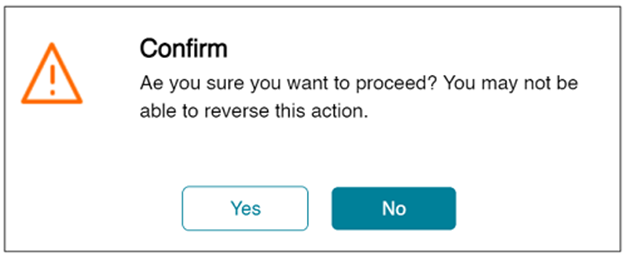

4. The system displays the Confirm message asking if the user really wants to Withdraw application.

5. Click No, if you do not want to withdraw the application.

6. Click Yes to continue. The status of the credit application changes to Withdrawn.

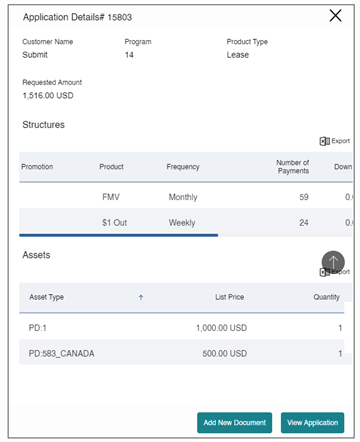

Viewing Application Details

Click View Application Details to view the application details. The Application Details window includes buttons – View Application and Add Document.

If you try to view the incomplete application details, then following error message is displayed.

Dealer Portal Home Page Menu

The Dealer Portal provides quick access with an easy view to the status of your portfolio. The menu can be accessed by clicking Home which you can navigate to the menu as shown below, this provides relevant information regarding your portfolio.

Servicing Tab Overview

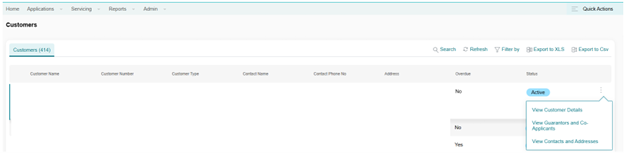

Within the Servicing Tab, you can select Customers.

Customers

Once Customers is selected you can view the following:

• Customer Name

• Customer Number

• Customer Type Customer Phone No.

• Address Overdue

• Status

-

View Customer details

-

View Guarantors and Co-Applicants

-

View Contracts and Addresses

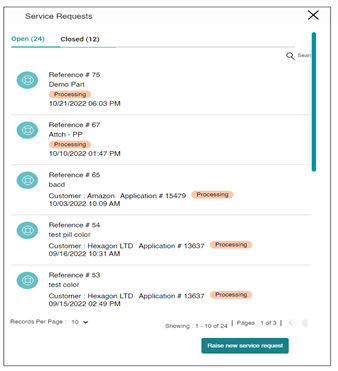

Service Request

A service request from the Dealer Portal perspective is to raise a ticket for any activities or any transactions that a Portal user is unable to perform. In the Dealer Portal, the dealer can raise a Service Request to complete those service requests that are initiated by the dealer. For example, a Dealer Portal user can submit a Service Request to add a new location, request a payoff, etc.

Dealer Portal – Service Request

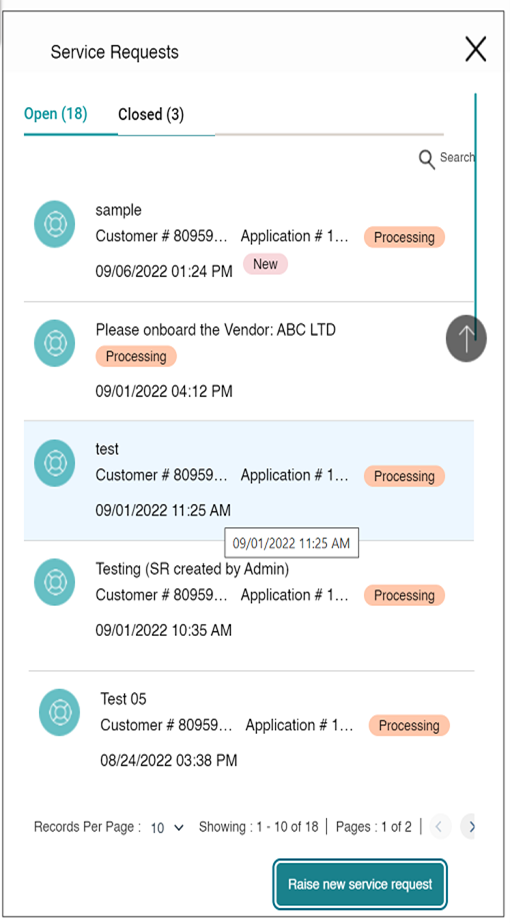

From the menu pane, access Servicing> Service Requests. This action opens the Service Requests window. Additionally, you can also open it from the Quick Actions menu available on the right side of the Dashboard.

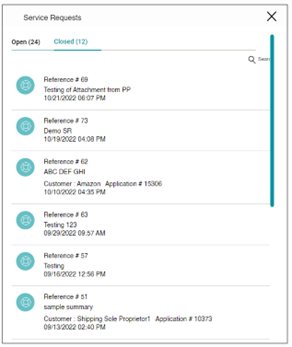

Open Service Requests

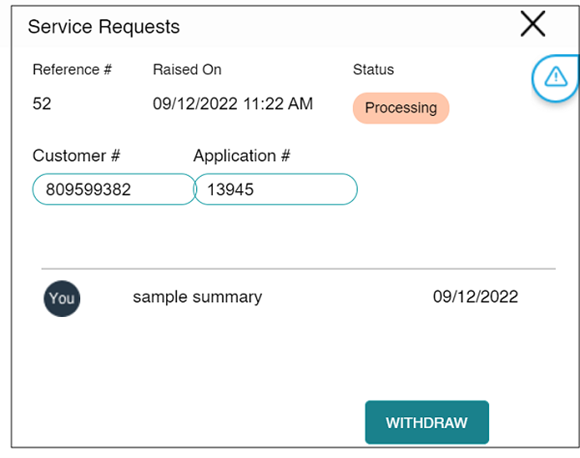

The Service Request window displays the total number of open Service Requests. The open Service Requests are those request that are raised and under process, but yet to be completed.

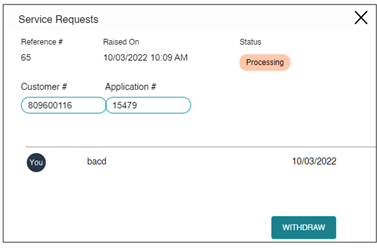

Double click the Service Request to view details. This action opens the Service Request window. The Service Request window displays the Reference number, Raised date and Time, current Status, Customer number, Application number, and Summary details.

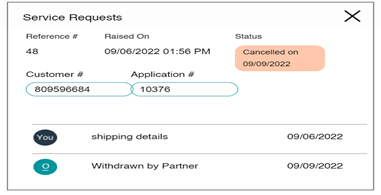

Closed Service Requests

The Service Request window displays the total number of closed Service Requests. The closed Service Requests are those request that are completed and closed for various reasons, such as cancelled.

Double click the Service Request to view details. This action opens the Service Request window. The Service Request window displays the Reference number, Raised date and Time, current Status, Customer number, Application number, Summary details, and Description.

To Create a Service Request

1. Hover over Servicing Menu or Quick Actions and click Service Requests. This action opens the Service Request window.

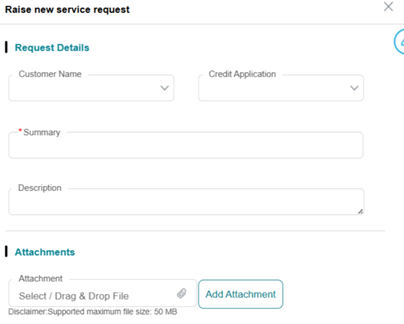

2. Click Raise New Service Request. This action opens the New Service Request window.

3. Enter following details in New Service Request window.

a. Customer Name: Select the Customer Name from the drop-down list. This is an optional field.

b. Application #. If required, select the Application number from the drop-down list. This is an optional field.

The fields Customer name and Application are optional fields. That means a portal user can always go ahead and create an open-ended service request not linked to any kind of entity. But if a portal user wants to go ahead and create a service request towards a specific customer or a specific credit application, they can go ahead and do so. Summary: Enter the service request summary. This field is mandatory.

d. Description: If required, enter Description.

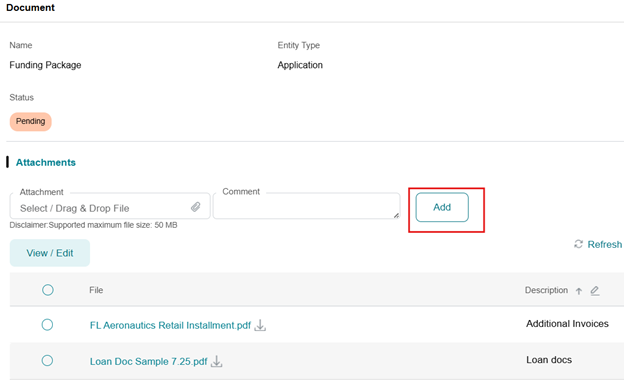

e. Attachments: If required, you can attach a document/image for reference. Select/drag and drop file from your system and click Add to attach the documents. You can add multiple reference documents in the form of attachments. And this also supports any file extension such as image file or PDF file.

f. Click Cancel if you do not wish to raise a service request.

g. Click Submit to continue.

The system displays the success message that service request raised successfully.

h. The request created is displayed on the Service Requests window along with the status of the request.

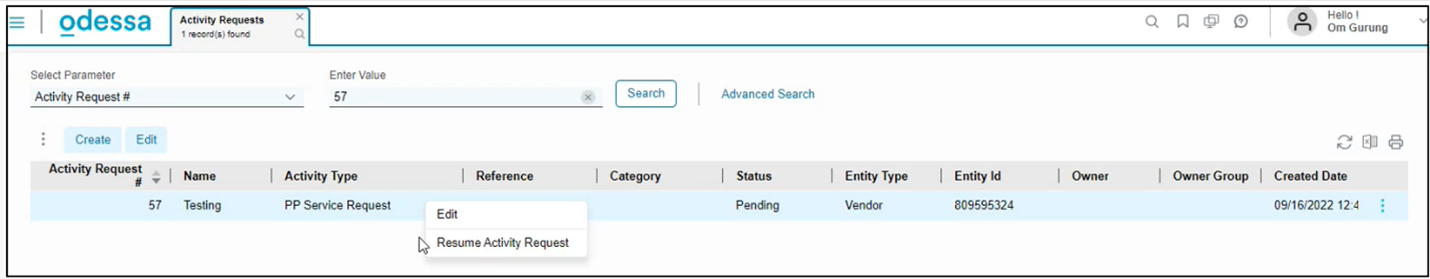

To Browse for a Service Request

1. To search for generated Service Request in the Partner Portal, double click the required Service Request in the Service Request window and copy the **Reference **number.

2. Next, under Activity Request, select the search parameter as Activity Request number and enter the Reference number. The Service Request details are displayed in the list-view.

To Withdraw a Service Request

If required, a Service Request can be withdrawn for various reasons.

Note: You can withdraw only pending or processed Service Requests. The Service Request with closed status does not have the Withdraw option.

1. Click Withdraw to withdraw a Service Request.

2. The system displays the warning message.

3. Click No if you do not wish to withdraw the Service Request.

4. Click Yes to withdraw the Service Request.

5. The withdrawn Service Request appears in the Closed Service Request list.

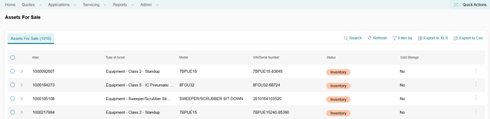

Assets

Once selected Assets you can view the following:

• View Assets

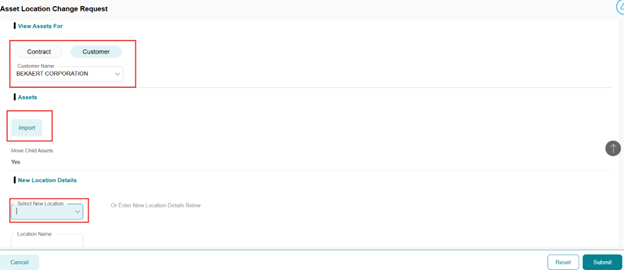

• Location Change Request

• View Assets

• Location Change Request

- In the bottom right you will select New Request.

-

A pop-up screen you will appear. Select a Contact or a Customer Related assets and address will be linked to the Contact/Customer

Import Assets in the Assets section you will import the individual asset that is changing.

-

Tab to Select New Location Details Existing customer locations will show. If it is a New location – Enter New Location Details – Add Location Name

and Address along with the Effective Date.

Click Submit.

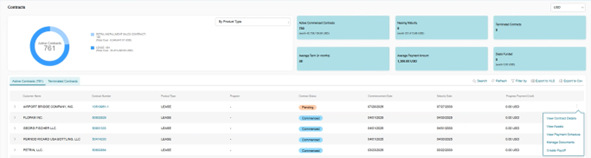

Contracts

Once Contracts are selected you can view the following:

• View Contracts

-

Detailed information can be found within the three dot edits when drilling down for information.

-

Contracts are highlighted in blue. Double click on viewing.

Assets for Sale

View Contracts

• Manage Payoff Quotes

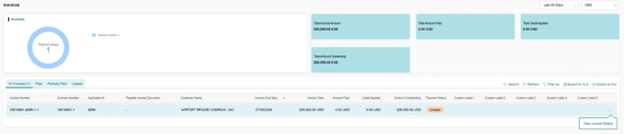

Invoices

Once Invoices are selected you can view the following:

• Dealer Proceeds: The Invoices section allows you to view the status of your dealer proceeds status.

Reports

The Partner Portal facilitates you to generate reports. You can also save the generated report as a template. This template can be used in the future to generate reports or schedule report generation. You can generate a report for Contract and Asset By Contract. The Reports module includes following sections:

Report List

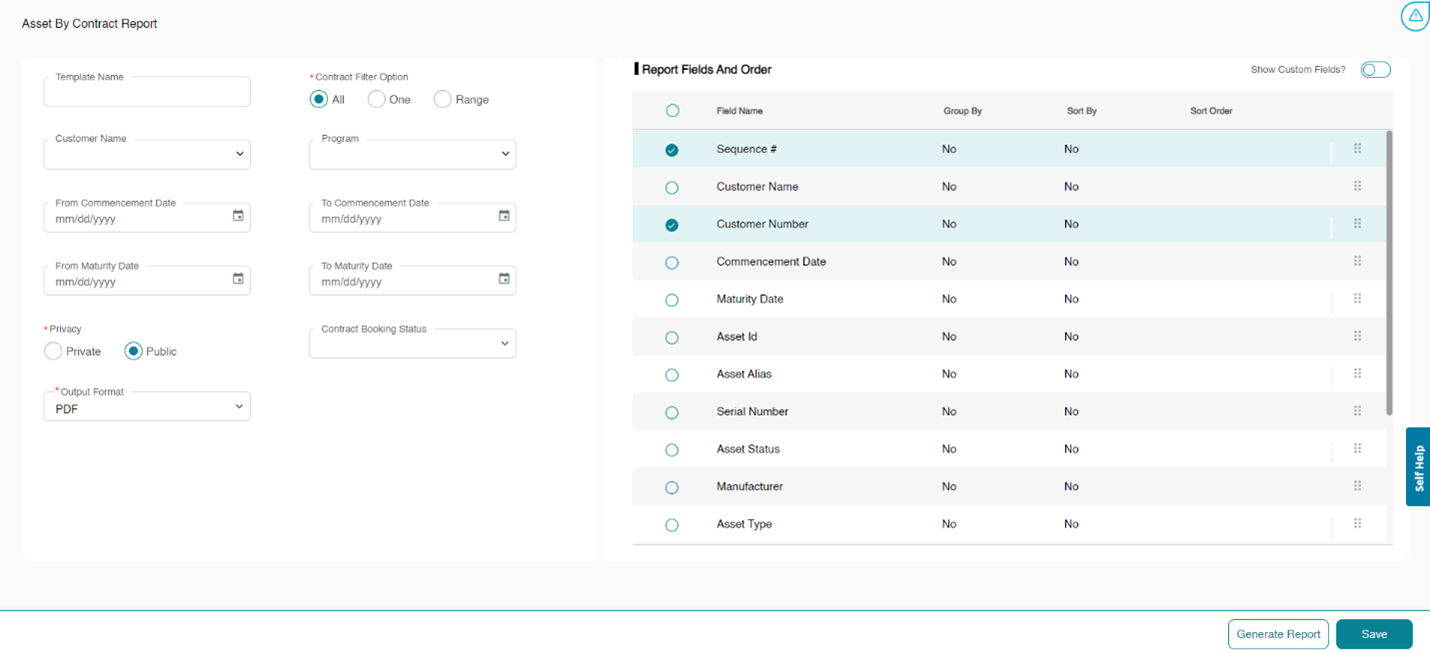

Generating Asset by Contract report

The Asset by Contract report lists the details of the assets for a particular contract. To generate a report for Asset by Contract, perform the following steps:

1. Hover over Reports > Report List and click Asset By Contract Report.

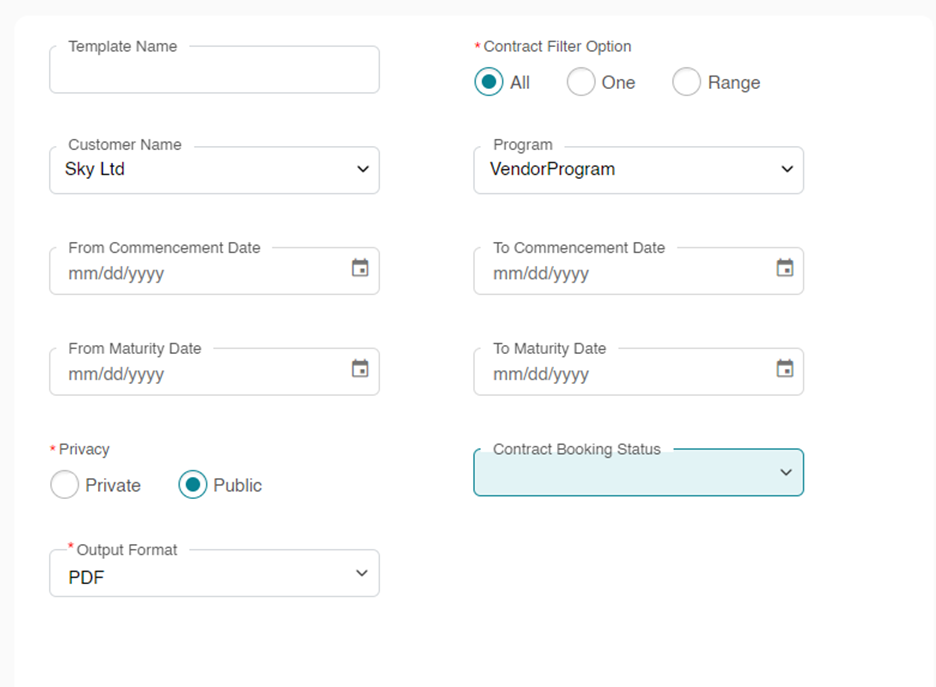

2. Optionally, enter the Template Name in case you wish to save the report template for future use. You can generate a report without saving the template for it.

3. In the Contract Filter Option field, choose if you wish to view the report for all available contracts (All), a specific contract (One), or a set of contracts (Range).

All

1. Optionally, you can further choose to enter information for the following filters:

• Customer Name: Select the Customer Name from the drop-down list.

• Program: Select the Program from the drop-down list.

• Contract Booking Status: Select the Contract Booking Status from the drop-down list.

• Commencement date range: Select the From Commencement Date followed by To Commencement Date.

• Maturity date range: Select the From Maturity Date followed by To Maturity Date.

2. Select the Report Privacy as required.

• Private: Generated Report/Template would be visible only to the person who created it and portal admins.

• Public: Generated Report/Template would be visible to all Partner Portal users

3. Select the Output Format of the report.

4. Select Show Custom Fields if you wish to add the custom fields to the report.

5. Select the fields which should be included in the report.

Note: In case you choose to generate a report for a specific contract (One), then select the Sequence # for which you wish to generate the report. For a set of contracts (Range), select the From Sequence # followed by selecting To Sequence #.

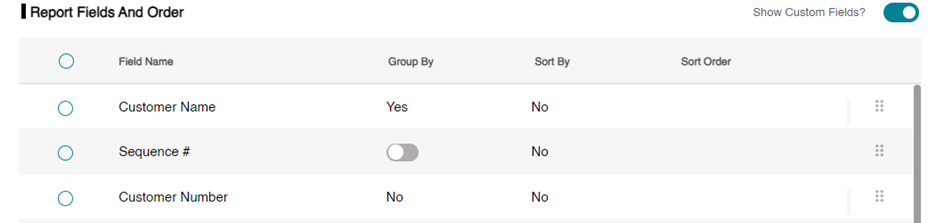

To Group Similar Groups Together

Using the Group By option, you can group similar field values together. For example, if you wish to group the data using the Commencement Date field, then all the contracts having the same commencement date will be grouped together. Perform the following steps to use Group By option.

1. Select the Field Name using which you wish to group the data.

2. You can group the data in the report using one field only.

3. Click No and select the toggle button to turn it on.

4. Click anywhere outside the Group By column to see the change in value. The value of the Group By for the selected field turns to Yes.

To Sort the Report in Ascending or Descending Order

The Sort By option allows you to sort the report in ascending or descending order. You can sort the report using one field only. Perform the following steps to use Sort By option.

1. Click No corresponding to the field using which you wish to sort the report.

2. Select the toggle button to turn it on.

3. Click anywhere outside the Sort By column to see the change in value. The value of the Sort By for the selected field would turn to Yes.

4. In case you also wish to sort the report in descending order, click Ascending in the Sort Order column and select the toggle button to turn it off. By default, the report would be ordered in ascending order.

Note: If the toggle button is turned on, it indicates that the data would be ordered in ascending order. Alternatively, if the button is turned off, the data would then be ordered in descending order.

5. Click anywhere outside the Sort By column to see the change in value. The value of the Sort By for the selected field would turn to descending.

6. Optionally, click Save if you wish to save the report template for future use.

7. Click Generate Report to generate the report.

8. Upon successfully generating the report, you receive the following success message.

9. The generated report automatically opens in a new browser tab from where you can download the same.

Contract Report

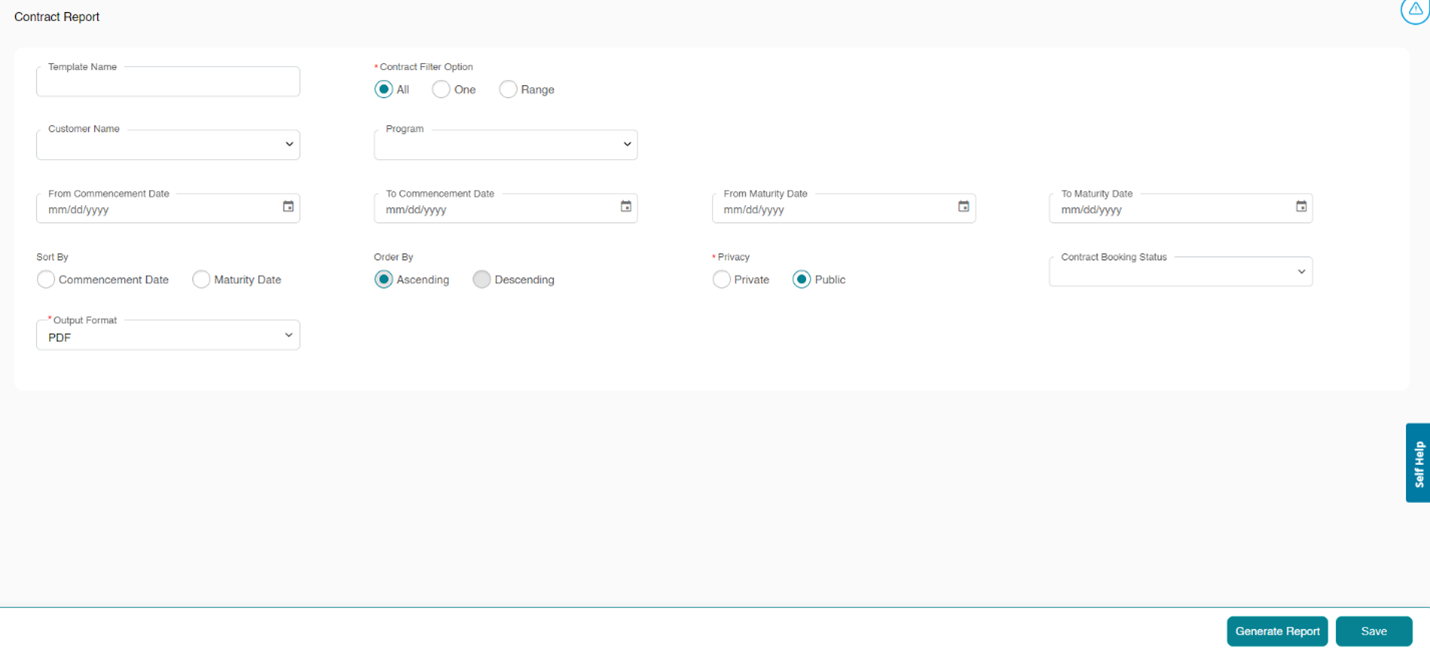

The Contract report lists the details of a particular contract. To generate a Contract Report, perform the following steps:

1. Hover over Reports > Report List and click Contract Report.

2. Optionally, enter the Template Name in case you wish to save the report template for future use. You can generate a report without saving the template for it.

3. In the Contract Filter Option field, choose if you wish to view the report for all available contracts (All), a specific contract (One), or a set of contracts (Range).

All

1. Optionally, you can further choose to enter information for the following filters:

• Contract Booking Status: Select the Contract Booking Status from the drop-down list.

• Customer Name: Select the Customer Name from the drop-down list.

• Program: Select the Program from the drop-down list.

• Commencement Date Range: Select the From Commencement Date followed by To Commencement Date.

• Maturity Date Range: Select the From Maturity Date followed by To Maturity Date.

• Sort By: Select the option as Commencement Date or Maturity Date.

• Order By: Select the option as Ascending or Descending.

2. Select the Report Privacy as required.

• Private: Generated Report/Template would be visible only to the person who created it and portal admins.

• Public: Generated Report/Template would be visible to all Partner Portal users.

3. Select the Output Format of the report.

Note: In case you choose to generate a report for a specific contract (One), then select the Sequence # for which you wish to generate the report. For a set of contracts (Range), select the From Sequence # followed by selecting To Sequence #.

4. Optionally, click Save if you wish to save the report template for future use.

5. Click Generate Report to generate the report.

6. Upon successfully generating the report, you receive the following success message.

7. The generated report automatically opens in a new browser tab from where you can download the same.

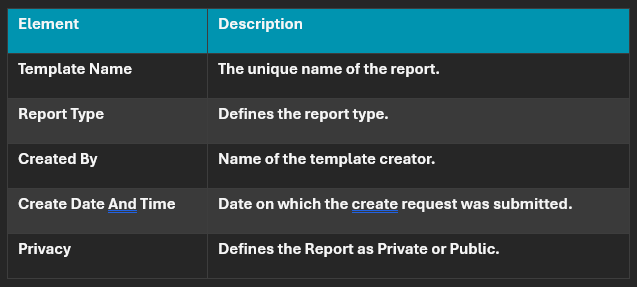

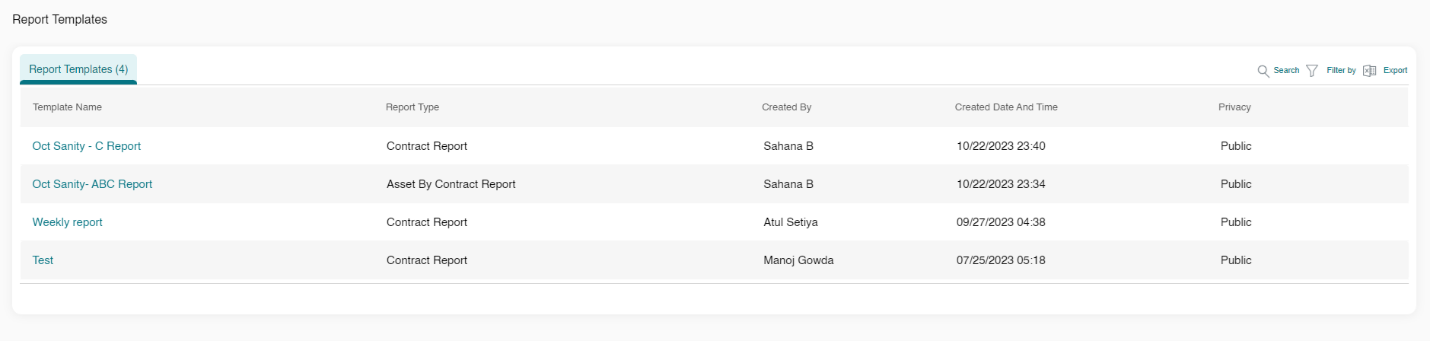

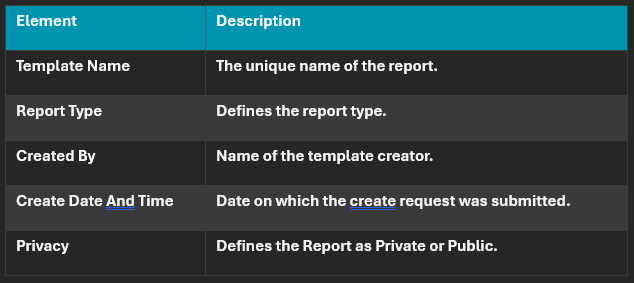

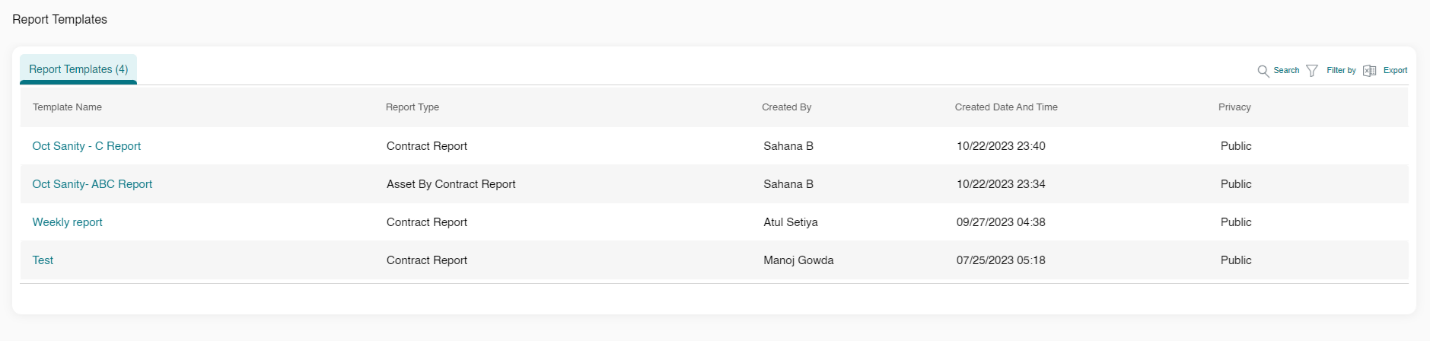

Report Template

The Report Templates page displays the report templates created by you in the past. To view the report templates, hover over Reports and click Report Templates. For each listed report, you can view the following set of information.

To edit the report template, perform the following steps:

-

Click the template name.

-

Edit the editable fields as required by you.

-

Optionally, click Save if you wish to save the report template.

-

Click Generate Report to generate the report.

Report Scheduler

The Report Templates page displays the report templates created by you in the past. To view the report templates, hover over Reports and click Report Templates. For each listed report, you can view the following set of information.

To edit the report template, perform the following steps:

-

Click the template name.

-

Edit the editable fields as required by you.

-

Optionally, click Save if you wish to save the report template.

-

Click Generate Report to generate the report.

Amend Credit Application

Using the Partner Portal, you can request to Amend the application. The application must be in Accepted Status prior to executing an Amendment.

The Amend function can be used for the following scenarios:

• Credit Request – Application without Assets and Structures: This feature enables users to create an application and request a dollar amount without entering details of all the Assets. You will Amend an application to add Asset equipment details and structures after Approval.

• Application Amendment for Multiple Schedule: Multiple schedule structures apply to Leases only use Amend to add new assets and structures for multiple truck deals.

• Amendment of Deal Request (Credit Application): Originators will amend applications post credit approval as needed to modify assets, structures, and other financial or non-financial details until the contract is funded. Based on credit re-decision logic, risk-increasing changes will require re-evaluation. Other changes will proceed with standard review, document generation, and funding workflows.

Note: An Asset Type cannot be edited, a new application can be submitted, or a Service Request can be sent via the Partner Portal from the Home Screen.

Amend the Credit Application

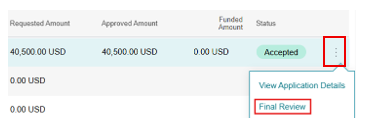

Navigate to the Amend Function from the three edit dots on the Accepted Application from the Home Screen.

You will see this in your Home Screen view when searching for the Application to Amend.

- Click on the three edit dots on the application line to pull up your menu.

• Amend: To Amend an Application the Status must be in be in Accepted (Approved) Status. If there are additional changes to your lease/loan you may need to use the Amend function.

• Amendments are required in cases as described below and can be found in the

Asset Tab and in the Structure:

Guarantor Tab:

- Add/Remove Third Party Guarantors

Asset Tab:

- Amount Financed

- Adding a new address not listed in the customer record.

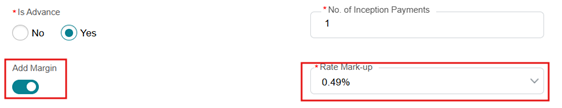

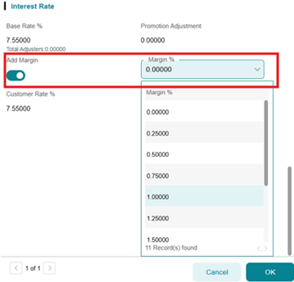

- Rate margin increase (Dealer Participation).

- Structural changes to the lease or loan.

- Some of these items may require credit review.

- Annual Usage

- Operating Environment

- Maintenance

- Location Address Change

Structure Tab:

- Structure-

-

Products (Loan, FLEX, Residual, etc.)

-

Number of Payments

-

Payment Frequency, etc.

-

Expected Funding Date

-

Due Date of the Month

-

First Payment Due Date

-

Down Payment

-

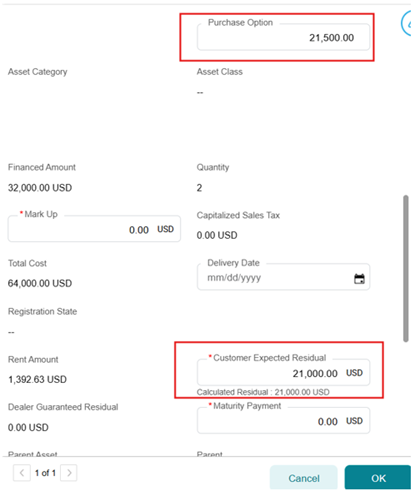

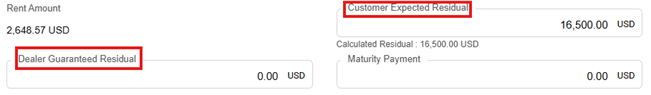

Customer Expected Residual (Within the Asset of the Structure Tab)

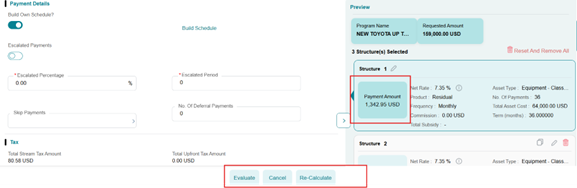

-

It is important to ONLY click the Re-Calculate Button. If Evaluate is clicked asset will revert back to the original customer expected residual.

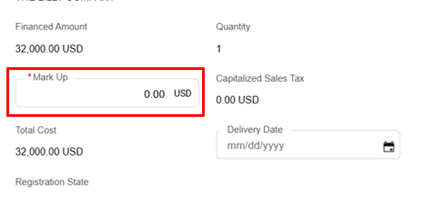

- Margin %/Mark Up (Within the Asset of the Structure Tab. It is important to ONLY click the Re-Calculate Button.)

NOTE: The Amend Function will not allow you to edit the following: Solution: If you have a change from the below list, please submit a service ticket through the portal and credit will assist in making the necessary changes:

- Asset Type

- Add or Delete Asset

- Asset Catalog

- Manufacturer

- Make, Model, Model Year

- Quantity (add or decrease)

Amend Changes – Margin Increase or Mark Up Used or Non-Toyota:

- There are two ways to increase the yield on your deal for Used equipment and Non-Toyota.

- Margin: Margin is the rate increase for dealer participation.

- Mark up: This is a dollar amount increase in your transaction.

• Amend Change Recalculate Button – PLEASE NOTE: To update the payment if you change the Customer Expected Residual or Mark Up/Margin, when you return to the main screen you will only click the Recalculate button.

• Although tempting, please do not select Evaluate. Selecting the Evaluate button will revert the deal to the prior structure.

• If there is an error, the solution is to re-do the Amendments you made, return to the main screen and only Recalculate.

• Amend Changes Complete: Once you make your changes you will Proceed through and Submit to Credit.

- Return to the home page and refresh your screen. Asset should reflect as Submitted.

- If you increased the Amount Financed or changed the asset the application may reflect in a Pending Status. Credit will have to review these items.

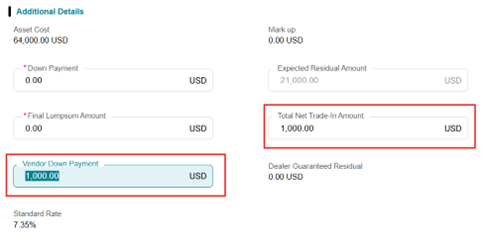

Amend Residual

• If you need to change your residual during Amend follow the process below.

• You may enter a higher/lower residual than the Customer Expected Residual.

• Entering an amount higher than the program residual will yield a dealer guarantee and an amount lower will increase the customer’s expected payment.

• NOTE: If you change the Customer Expected Residual, when you return to the main screen you will only click the recalculate button. Hitting the evaluate button will reset to the previous structure.

• Amend Changes Complete: Once you make your changes you will proceed through and Submit to Credit to put the changes into our core system for documentation.

- Return to the home page and refresh your screen. Asset should reflect as Accepted as long as there is no material change to credit risk factors.

- If you increased the finance amount or changed the asset the app may say Pending. If Pending, our Credit team has a queue and they will be reviewing these Amend Changes.

Once credit approves you can proceed to Final Review to from the Home Scree by clicking the three edit dots to create Contract Documentation and Initiate Takedown.

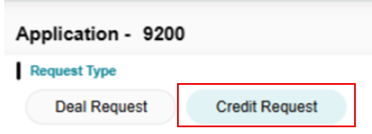

Create Credit Request Application

After you select Create Application, Credit Request (Line) you will select a customer type, New or Existing, to proceed.

Select Credit Request

By default, the system selects “Use Customer Line” if the customer has an active credit line.

After you select Create Application, Select Request Type as Credit (Line) then you will select a customer type, New or Existing, to proceed.

Selecting an Existing Customer:

• Type the customer’s name; matching records from your portfolio will appear.

o When searching for a customer, asterisks may be used as a wildcard. *al for Allied Welding, INC.

• Select the desired customer name with a correct Tax ID.

• Verify Existing Customer data.

• Customer Name and Tax ID change will require a Service Request.

For a new customer select the New Customer button.

Steps to Create a New Customer:

1. Complete the required customer credit information fields.

- Fields marked with a red asterisk (*) are mandatory and must be filled out to proceed.

2. Enter the relevant customer information:

- For company, enter Legal business name, Tax ID, State of Incorporation and Business Type.

1. The TAX ID Field will not be editable until the address is filled out.

- For individuals, you will be required to enter their full legal name, date of birth and SSN.

- NOTES and TIPS: As designed you will need to ADD an address before you can enter the Tax ID. Use Individual ONLY for Sole Proprietor.

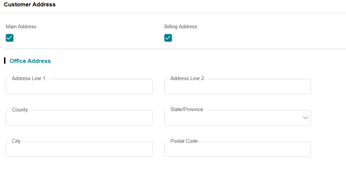

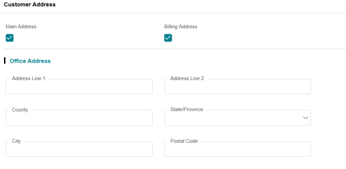

Adding a Customer Address

Steps to adding Customer Address:

1. Click “Add” which opens the address screen. You can add both the main address and the billing address, or separate the Billing Address, if known.

2. For the application the Main address should be the company’s Registered Address.

3. If the Billing Address is different from the main address. Deselect the Main Address checkbox. Complete the main address and click “OK”. Add the billing address now by clicking, “ADD” new address and enter the billing address as needed.

a. Adding a Billing Address is not required for application submittal.

4. Click OK and the added address should appear in the address section.

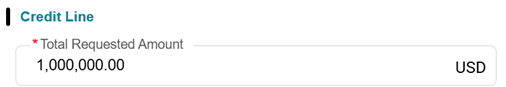

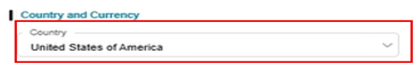

• When “Credit Request” for a new line of credit was selected:

- Instead of a program selection, a Credit Line section will be displayed at the bottom left of the page.

- Enter the requested credit line amount in the designated field.

Scroll down to the Country: Country must be selected from the drop option as is required.

Click the Proceed button which will take you to the Guarantors and CoApplicants Tab.

Proceeding to the Next Step

• Once you have made your finance program selection, click “Proceed” at the lower right of the screen to continue to the Guarantors & Co-Applicants section of the application.

![]()

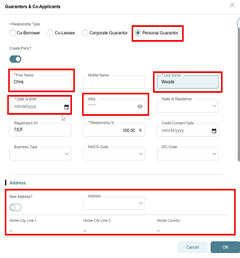

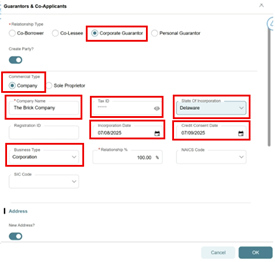

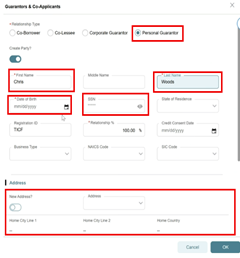

Adding a New Guarantor

• You will add a new guarantor by clicking the “Add” button.

- Personal Guarantor Notes:

- Personal Guarantor – You will need to add an address prior to inputting the SSN.

-

SSN Format: You will need to use 123-12-1234

-

Check Business Type: Individual would be selected.

-

Date of Birth.

-

Credit Consent Date should be pulled down based on receipt date of authorization for credit; ie when you received the signed app.

-

Select or Complete Address

• Cross Corporate Guarantor Notes:

- Personal Guarantor – You will need to add an address prior to inputting the Fed Tax ID.

- Tax ID Format: You will need to use the 12-345678.

- Complete State of Incorporation.

Proceeding to the Next Step

• Once you have made your finance program selection, click “Proceed” at the lower right of the screen to continue to the Guarantors & Co-Applicants section of the application.

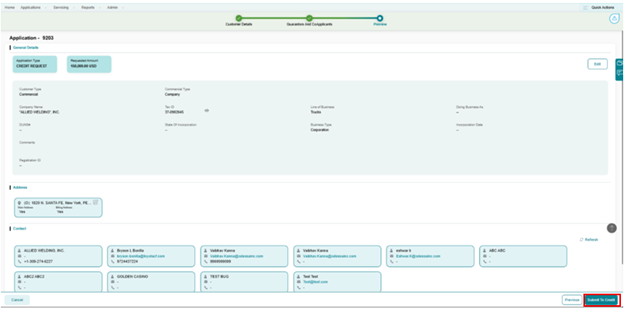

Preview Tab

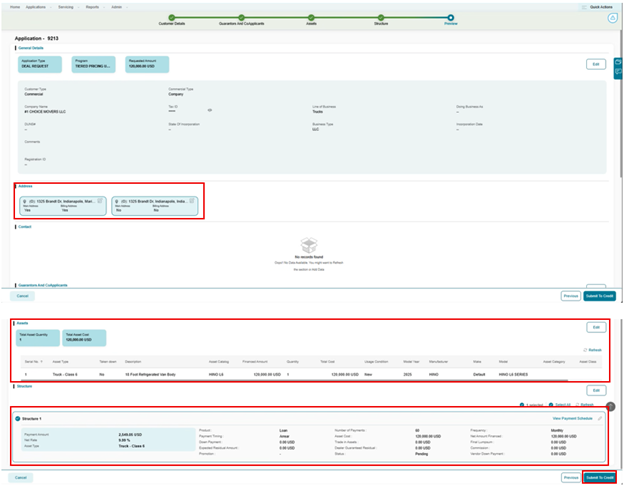

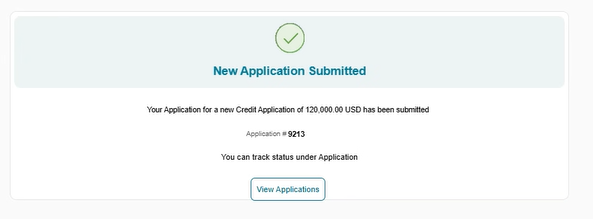

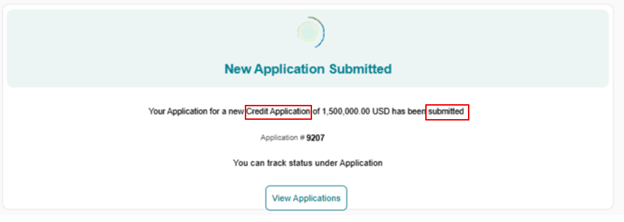

• Once you are on the Preview Tab, review the information for accuracy and select Submit To Credit.

Confirmation will be received stating, your Application for a new Credit Application has been submitted.

A confirmation message will be displayed as shown below.

Verification of Credit Decision Letter is located in the Documentation Tab.

NOTE: Once you have your asset information a Deal Request will need to be submitted to draw down on the credit line. The Deal Request will be automatically approved if the customer has credit availability.

Hino Deal Request Credit Application

Create Application

Select Create Application, Select Deal Request you will select a customer type, New or Existing, to proceed.

Note: The system will default to Existing Customer.

Selecting Credit App and Deal

• Once “Deal Request” is selected

o After entering customer information, Program will appear at the bottom left of the page.

o Select the appropriate Finance program, such as Tiered Pricing up – 6 mo. Rate lock, etc. You can only select one Finance Program per Application from the dropdown menu.

o If you have two different program types, they must be submitted separately on different applications.

Selecting an Existing Customer:

• Type the customer’s name; matching records from your portfolio will appear.

o When searching for a customer, asterisks may be used as a wildcard. Example: “*al ” for Allied Welding, INC.

• Select the desired customer name with a correct Tax ID. The last 4 of the ID will show

• Verify Existing Customer data.

• Customer Name and Tax ID change will require a Service Request.

For a new customer select the New Customer button.

Steps to Create a New Customer:

- Complete the required customer credit information fields.

- Fields marked with a red asterisk (*) are mandatory and must be filled out to proceed.

- Enter the relevant customer information:

- For Individual this will commonly be used. Please do not use Sole Proprietor

- For company, enter Legal business name, Tax ID, State of Incorporation and Business Type.

- The TAX ID Field will not be editable until the address is filled out.

- For individuals, you will be required to enter their full legal name, date of birth and SSN

NOTES and TIPS: As designed you will need to ADD an address before you can enter the Tax ID.

Steps to adding Customer Address:

1. Click “Add” which opens the address screen. You can add both the main address and the billing address, or separate the Billing Address, if known.

2. For the application the Main address should be the company’s Registered Address.

3. If the Billing Address is different from the main address.

Deselect the Main Address checkbox. Complete the main address and click “OK”.

Add the billing address now by clicking, “ADD” new address and enter the billing address as needed.

- Adding a Billing Address is not required for application submittal.

4. Click OK and the added address should appear in the address section.

Selecting Finance Program:

Scroll down to the Program Section.

Select your Finance Program.

Once you have made your finance program selection, click “Proceed” at the lower right of the screen to continue to the Guarantors & Co-Applicants section of the application.

![]()

Adding a New Guarantor if Required

• You will add a new guarantor by clicking the “Add” button.

• Personal Guarantor Notes:

o Personal Guarantor – You will need to add an address prior to inputting the SSN.

o SSN Format: You will need to use 123-12-1234

o Check Business Type: Typically, individual would be selected.

o Date of Birth.

o Select Address

• Cross Corporate Guarantor Notes:

o Corporate Guarantor – You will need to add an address prior to inputting the Fed Tax ID.

o Tax ID Format: You will need to use the 12-345678.

o Complete State of Incorporation.

Proceeding to the Next Step

• Once you have made your finance program selection, click “Proceed” at the lower right of the screen to continue to the Assets tab section of the application.

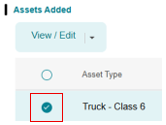

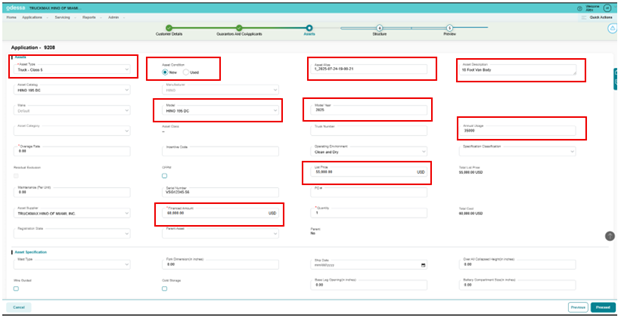

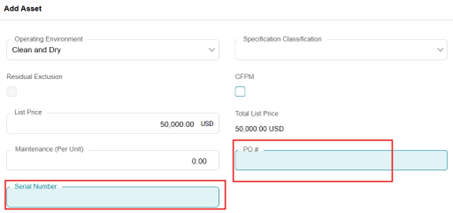

Asset Tab – Manually Adding an Asset

You will tab through the fields on this page to complete.

• You must manually add the product you are financing to the Asset.

• Fields marked with a red asterisk (*) are required and must be completed to proceed Click Add Asset Button.

• Asset Type is the truck, body which is the collateral that is financed. This is a drop-down field where the truck Class is selected.

• Asset Condition New or Used must be selected.

• Asset Alias auto populates as a system unique asset identifier. No need to change.

• Asset Description: This is a free form field. Data input here will be transferred to the documents. Example: some items listed could be 28’ Box, Superior Tank, chassis and other attachments, etc. This is a required field for bodies and attachments.

• Asset Catalog: This a drop-down list of models. You can also type in the model type and like models will appear in the pull-down menu.

• Model Year: Required. This is free form and identifies the year and is required for residual calculations.

• Annual Usage is a required field.

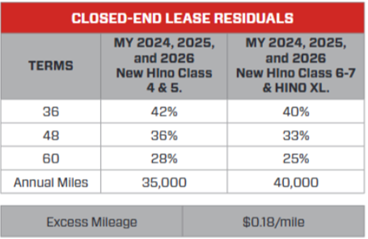

o For Loans and TRAC please utilize 1.

o Close-End Leases please utilize 35,000 or 40,000 miles. Excess Mileage is $0.18 per mile.

• Operating Environment: (Not Applicable)

• Dealer Cost: This is the wholesale dealer cost for a new asset and the current market/book value for a used asset.

• Maintenance: (Not Applicable)

• Serial Number and PO: Not required at application stage. Can be added at Documentation. Please include the Serial Number if available in the serial number field.

• Dealer Sales Price: This is your dealer sales price (before down payment or trade in).

• Quantity: Total number of units

• Mast Type: (Not Applicable)

• Mast Elevated Height: (Not Applicable)

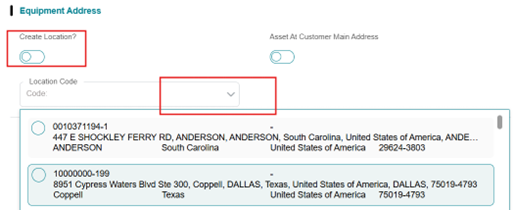

• Equipment Location Address: A location address can be added if known.

o Please see below for reference:

- NOTES and TIPS – Equipment Location Address:

- The system works on codes for addresses. All first-time applications in the system will require you to update the address.

- Best Practice:

- 1st Time – Select Create Location.

- If new or the address does not show, select Create Location and complete the form.

- Going forward you will select a location address from the Location Code

- These Location Codes are based on addresses in the system’s customer record.

- Click on the down arrow under the Location Code field. All addresses saved for this customer will be shown going forward.

- 1st Time – Select Create Location.

- NOTES and TIPS: If you do not select a location the tax will not show in pricing, and you will have to amend when you get to the documentation.

Once all assets have been confirmed, click Proceed on the bottom right.

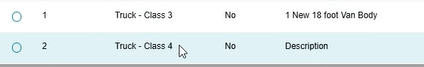

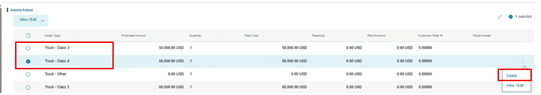

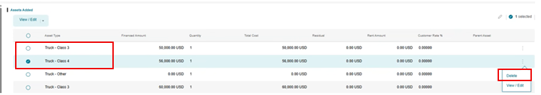

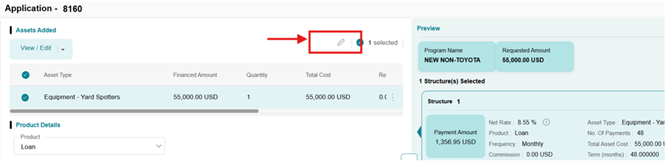

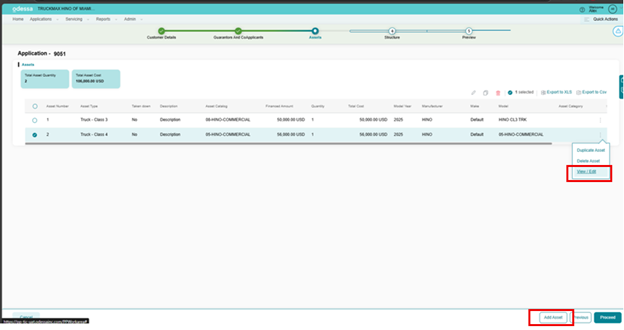

Review/Add/Modify Assets

Add multiple assets only if required. After clicking Proceed, you will be presented with a screen displaying the asset(s) you have added:

• Add more assets, click the Add Assets button at the bottom right.

• To modify or remove an asset, either double click within the asset box or use the pencil or click the three edit dots next to the asset line item on the far right.

• In addition, you can also Duplicate an existing asset.

o Duplication is a great way to split assets

o NOTES and TIPS: When you Duplicate an asset, you will always need to update the Asset Alias.

o Best Practice: Asset Alias is required and needs to be unique. You will change the asset Alias by adding a letter to the current Alias,

o Ex: 1_2025-07-24-21-00-40 change to 1_2025-07-24-21-00-40A

Proceeding to the Next Step

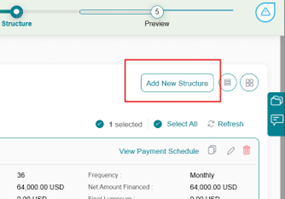

• Once all assets have been reviewed and confirmed, click “Proceed” to continue to the next section, Structure section.

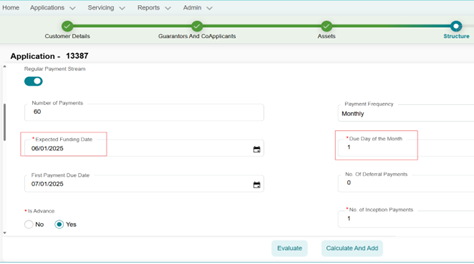

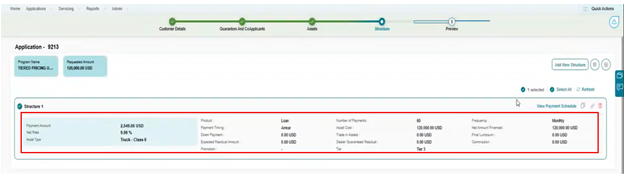

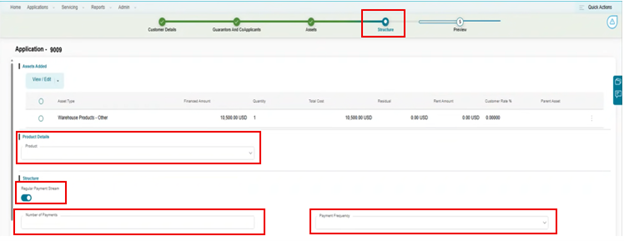

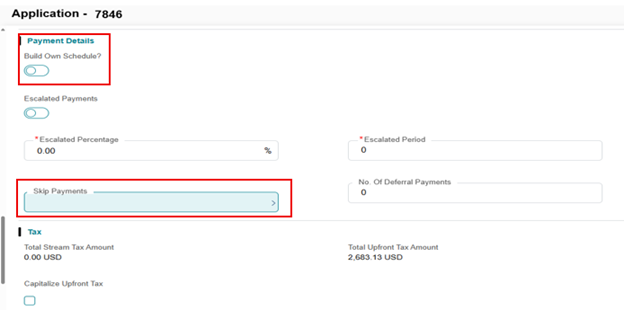

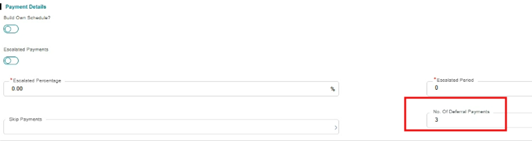

Structure Page Section – Payment Details

The system provides flexibility to build non-standard variable payment schedules. This accommodates irregular payment schedules that support customers’ business needs.

The functionality is located within the Structure Tab as shown below.

• The Product Details Must be selected to allow editing.

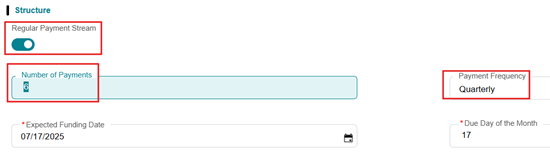

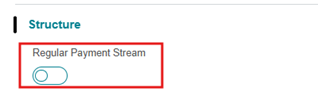

• Select the Please deselect the Regular Payment Stream to invoke non-standard schedules.

• Non-Standard and Variable Payment Schedules: For payments that are not monthly you can select Payment Frequency for Monthly, Quarterly, Semi-annually, Annually.

-

- NOTE: Number of payments is based on the frequency

- Ex: If using a 3-year term

- A Quarterly structure will be 24 payments, 4 per year for 3 years

- A Semi-annual structure will be 6 payments, 2 per year for 3 years

- Annual structure will be 3 payments per year for 3 years

- NOTE: Number of payments is based on the frequency

Additional Lease and Loan Structures

- You can build additional non-standard and variable structures

- Turn off Regular Payment Stream scroll down to the new section of Payment Details as shown below.

Payment Details Section (below) will open additional options for Build Own Schedule, Irregular, Seasonal and Skip structure.

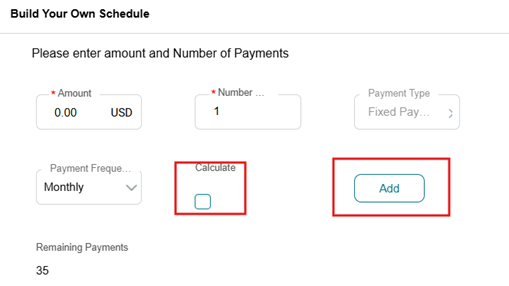

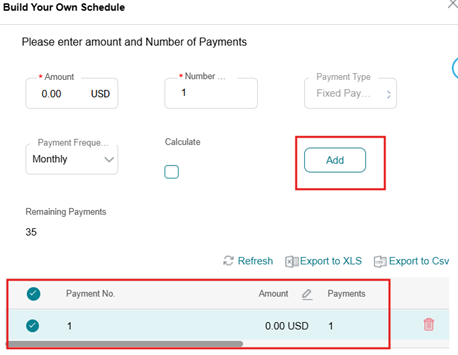

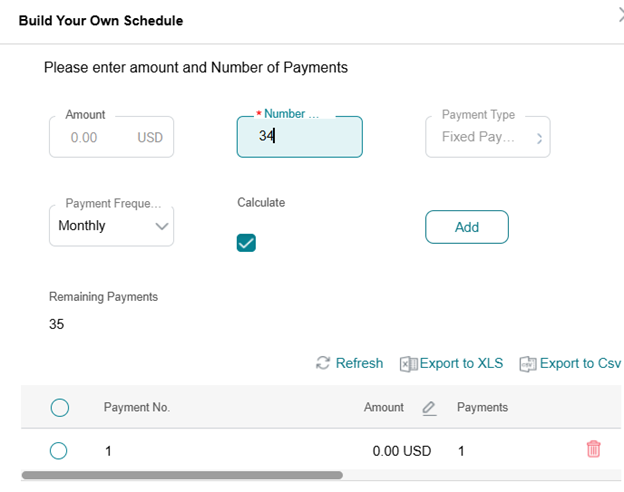

Build your Own Schedule: turn on the radio button. And click the hyperlink for “Build Schedule”.

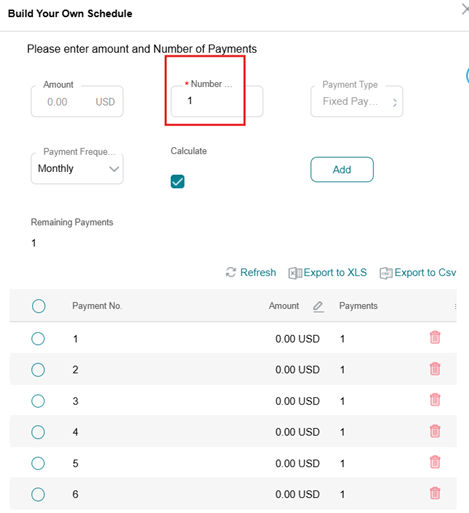

• A Build Your Own Schedule Window Opens:

o Build your schedule is a flexible calculator that allows you to set known payments and calculate unknown payments for the desired terms.

o As designed, you will add 1 payment first, whether predetermined or calculated. For our example we are using $0.00. You may change this later.

o Click Add Button to Add the first payment.

o Your Remaining Payments will show in the lower left.

o From here you will build out your schedule.

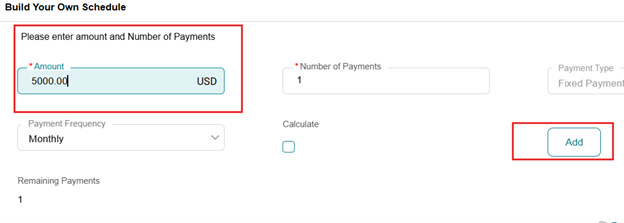

o Example Below: Balloon Payment:

o Add the 1st payment

o Select remaining payments as calculated

o With the 1 remaining payment you can add your balloon amount in the Amount Field, in this case $5,000.00.

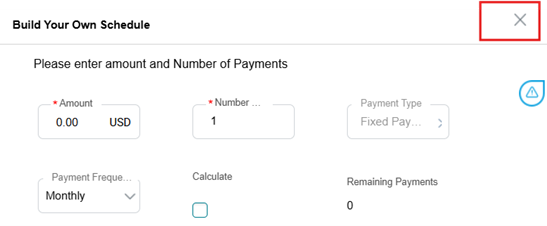

o Your structure is complete, and you will X (close the structure) out of this pop-up schedule box back to the main structure screen which you need to click on Evaluate and Recalculate the schedule you created.

o Your new payment will be shown in the structure box on the right.

o You can verify your custom schedule by clicking Proceed and View Payment Schedule.

• Calculate: Finalize the structure by closing this screen. Then proceed to Evaluate and Calculate the structure and the new payment will show in your structure.

Deferrals – Upfront:

• There is a deferral field that you can complete for the amount of deferred or skip payments a customer wants at the beginning of the lease. Evaluate and Recalculate and your new structure will show.

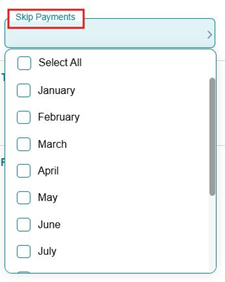

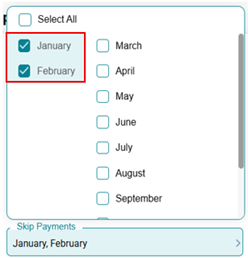

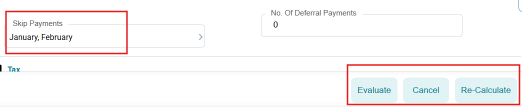

Seasonal Skip Payments:

• Select the arrow in the Skip Payments field and you will receive a chart of the month’s that you would like to skip.

• After selecting the skipped months, you will Evaluate and Calculate to view the schedule of payments.

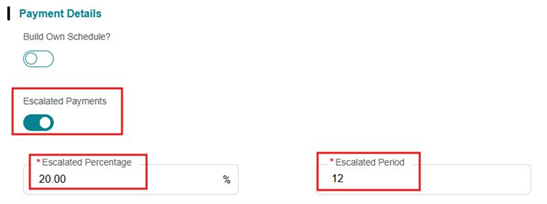

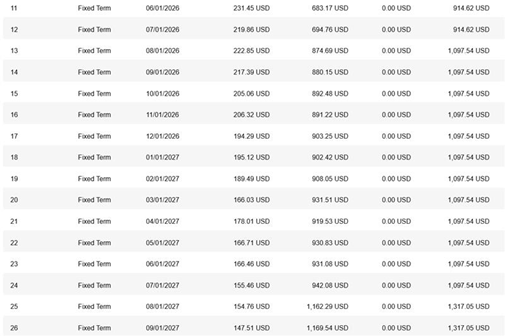

Escalated Payments: Are possible in the Dealer Partner Portal and refer to escalating payments in percentage increments over the term of the lease.

See the schedule below for reference.

• Select the Escalated Payments button and add the Escalated Percentage and Escalated Period desired as shown below.

• Once completed for the full term, you can view and print or download the actual schedule by clicking on Export to XLS or Export to CSV.

o Note, when exporting downloading data from Dealer Partner Portal using export to XLS or Export to CSV (![]() ) an error may appear. See Helpful Hints to Access Microsoft Edge.

) an error may appear. See Helpful Hints to Access Microsoft Edge.

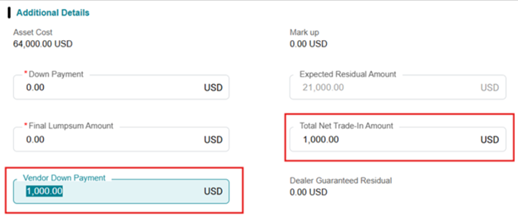

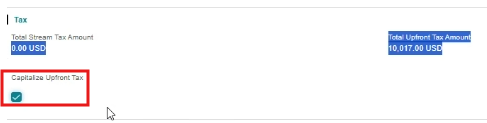

In the center of the Structure Tab, you will see the Additional Details section. Here you can add a down payment or other structure details.

When completed, click the Evaluate Button and then Recalculate Button.

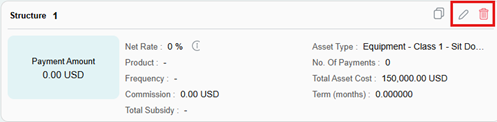

Additional Details:

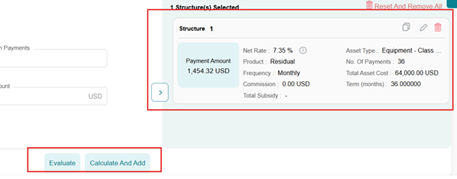

On the right side of the screen, a preview of your structure is displayed.

This provides the ability to Modify and Remove the Structure:

• Modify the structure by clicking the Edit icon on the structure line.

• Remove the structure by clicking the Trash Can icon.

If you modify a structure, you must click “Evaluate” and then “Re-Calculate” before proceeding.

Once all structures are completed, click “View Structures” at the bottom right of the screen to proceed to the Preview section.

Lease/Loan Documentation Overview

Application Search:

• Once you are ready to create documents from the Partner Portal Dashboard home screen you can search for your application several ways.

o Sort by Customer Name, Date Submitted or in the Application section, Click Filter to search for the application.

o You can filter by Application #, Customer Name, etc. then click Apply.

Final Review:

• The Final Review process allows you to review and update key deal information prior to documentation. Select Final Review using the three edit dots, select Final Review and this will take you into deal summary page.

o Changes: If there are changes that need to be made to the deal, please refer to the Amend Tab on the Dealer Training Center.

• Within the Final Review summary page, you can double click on the asset, and a pop-up page will show allowing you to edit the following items:

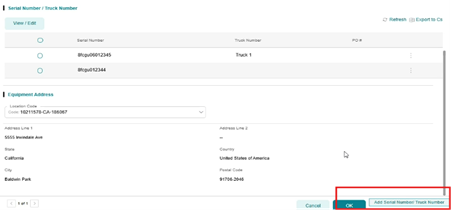

o ADD or update the Serial Numbers/VIN and Purchase Order Number

o Serial Number: If you have multiple assets, you will see a slightly different screen.

• Multiple Asset View

Note: If you do not see the field as editable in Final Review, please perform the Amend Function. For instance, not all fields are editable in Final Review and will require an Amend Function, please see the Amendment process guide.

• Location Verification:

o If the location is correct from the application, you can proceed

o If you need to add a new location:

o From the Location Code field select an address from the customer record.

o If there is a new address, then you will need to Proceed to the Amend process.

• Summary Page: Click Ok to move back to the summary page.

• Key Step: Once the Final Review is completed select Save.

o This is important to save the deal information in the system enabling you to create the documents.

o Do not click on Initiate Takedown. This is the absolute final step once documents are executed and ready for funding.

Documentation for Lease/Loan

The application must be in Accepted status to create Documents.

For Documentation, find the Application in the Home Screen, use the three dots to go to Final Review shown below:

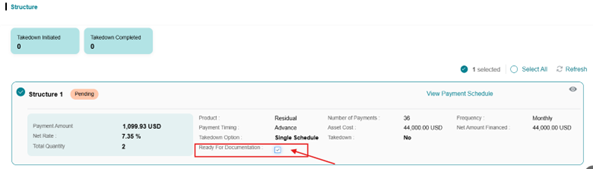

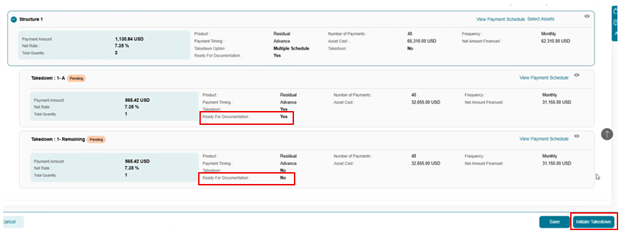

• Ready for Documentation: This is your first step to start the document process. In your Summary page scroll down to the Structure section.

• Select the Structure you want to Document

o Click No, once No is clicked, a box will appear, check the box and it will change to Yes.

Note: It is important to note that Ready for Documentation must reflect Yes in order to proceed with Initiate Takedown.

Selecting your Structure:

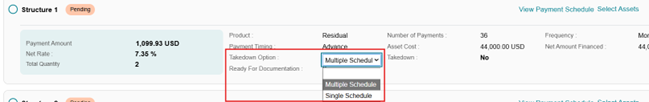

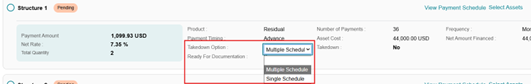

• Takedown Option: Then select a desired structure or multiple structures for documentation by clicking the radio button in the upper right of the desired structures.

o Single Structure: If all assets are the same, delivery date and/or location are the same.

o Multiple Structure: If you are splitting assets, due to different delivery dates or separate locations, you will use the Multiple Structure pull down.

• Multiple Structure Schedules:

o To split units for different schedules. In the Takedown Option Field, you will be able to select Multiple Schedule to split assets by schedule.

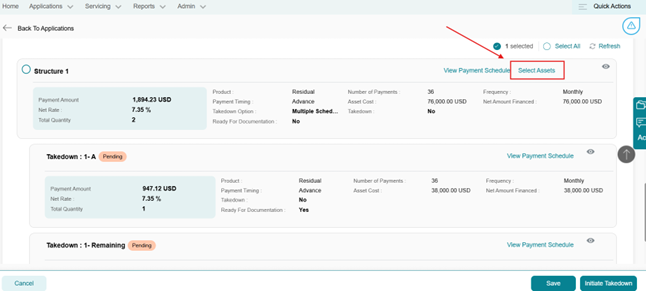

• Once Multiple Schedules are selected you will need to Select the assets that you want to split by choosing the Select Assets button.

• Select Assets: This will take the view to another screen.

o Takedown Quantity: Identify the units you are separating. There are 3 ways to complete this.

o You will hover over the Takedown Quantity, and the field becomes editable.

o You can click on the pencil next to Takedown Quantity

o Or utilize the View/Edit Button

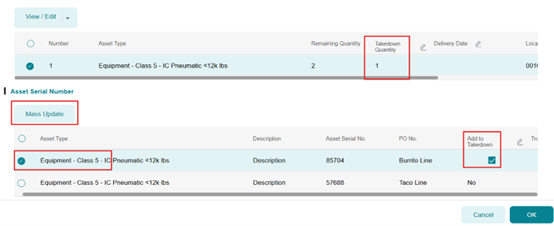

o Mass Update: Navigate to the Mass Update button to pull in all assets.

o All assets will show allowing you to choose the units to split.

o You can only Update assets with Serial Numbers.

o Add to Takedown: The last step is to hover over the Add to Takedown radio button and check it to add the selected unit(s) for documentation and click OK.

• If you have multiple assets, it may be easier to Select the Asset Type and use the Mass Update Button. This takes you to another screen will open up where you can select all items more quickly.

• Select OK to move back to the summary screen.

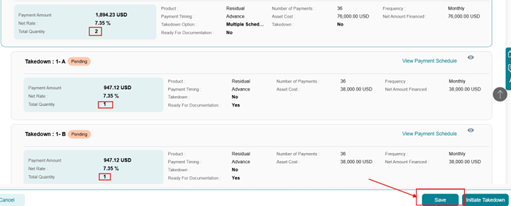

• Viewing split assets: Once complete you will see two (or multiple) Takedown’s that will be available for documentation.

o Follow the documentation process below.

• Click the Save button. Now your assets are ready for you to create and save the documents.

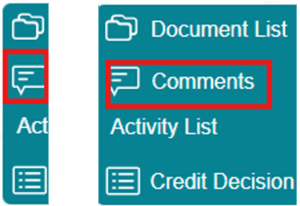

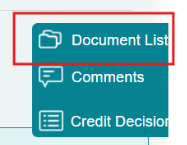

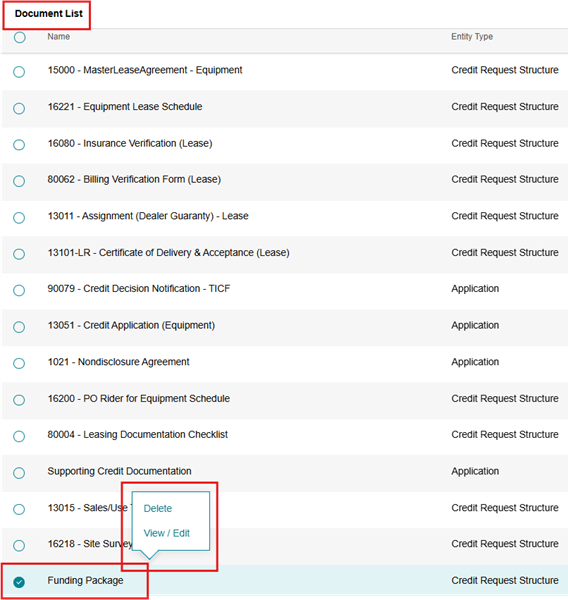

• Document: To produce your documents. On the right side of your screen there is a Slide out Menu, select Document List and a pop-up screen will appear with all the required documents for your selected structure.

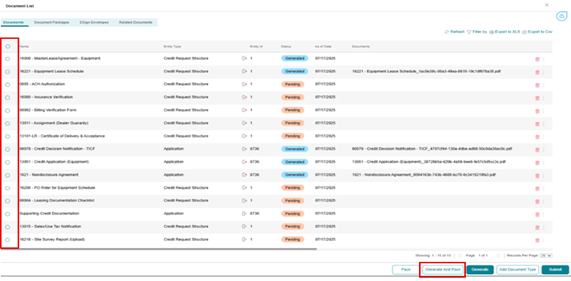

• Document List: From the document list you will click on the radio button to select the documents you want to produce for this transaction.

o You can create single documents or multiple documents as needed.

• Multiple Documents: How to Merge Documents – Generate and Pack:

o As you will likely have multiple documents there is a document merge function called Generate and Pack.

o After your selection of multiple documents, at the bottom menu Select the Generate and Pack button to group your documents together.

o A pop-up screen labeled Generate Pack appears. This has a field allowing you to name your merged packet.

o Click OK to proceed and you will return to the main document screen.

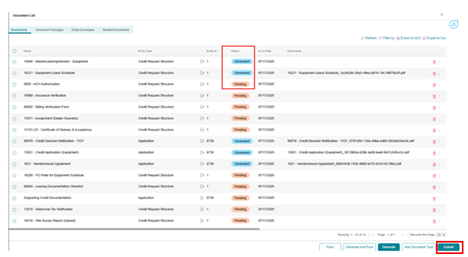

o Important Note – Submit: In the bottom right you must select the Submit button to save your documents for the deal. If you do not submit it does not import the application data to your lease or loan documents.

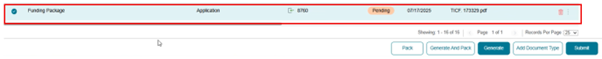

• NOTE: If your document line shows as Pending, it means documents have not been Generated. If it shows as Generated, it means documents have been created. Follow the documentation steps above if docs are not generated.

• View your Documents:

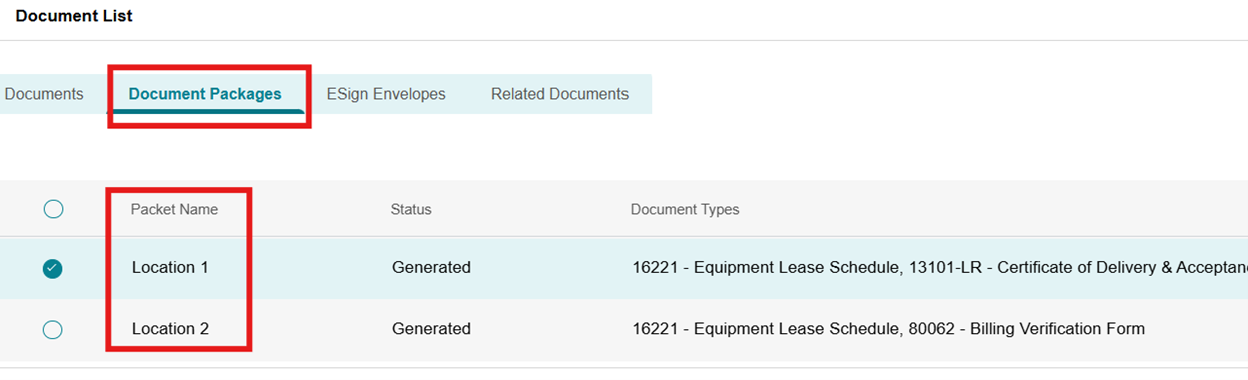

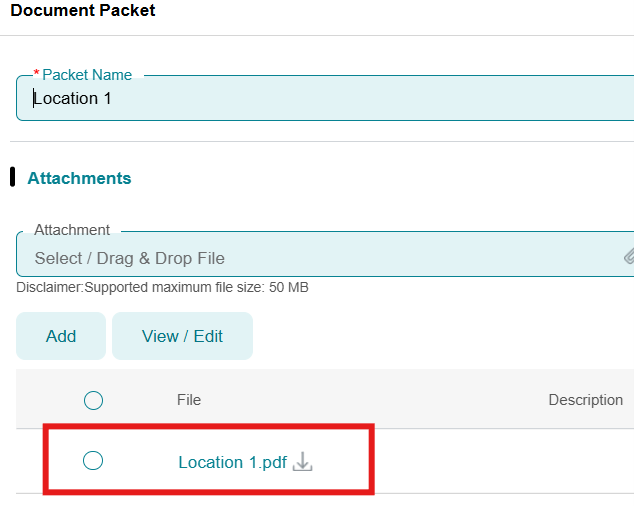

o From the Document List Menu. Select the Document Packages Tab. This will show the Packets you created.

o Double click on the Packet Name you need to view the PDF of your documents for accuracy.

Document Production for customer execution:

• There are two ways to send your documents to your customers.

o PDF: Print or email the pdf document to your sales team or customer directly.

o Dealer DocuSign: Insert the pdf into your own DocuSign/ESign programs so you can package lease/loan documents with the relevant dealer documents.

o Integrated Docusign: The Dealer Partner Portal is linked to DocuSign to allow you to use the internal DocuSign feature.

• Esign:

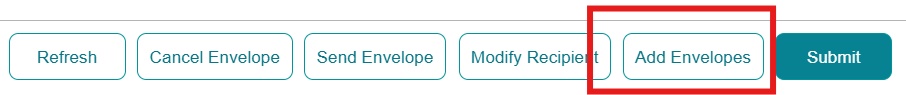

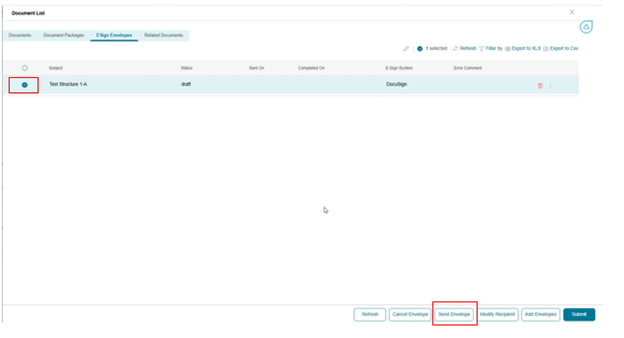

o Use the E-Sign Envelopes tab to invoke DocuSign.

o Select Add Envelope

o Note: If this is a new customer a contract will need to be set up to receive DocuSign.

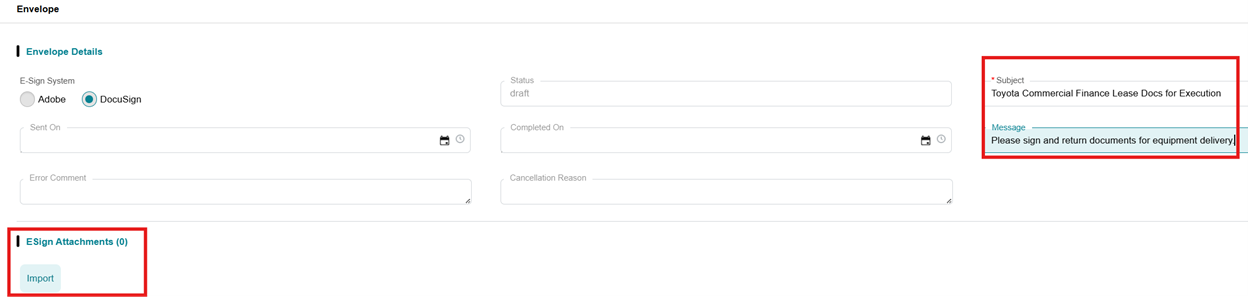

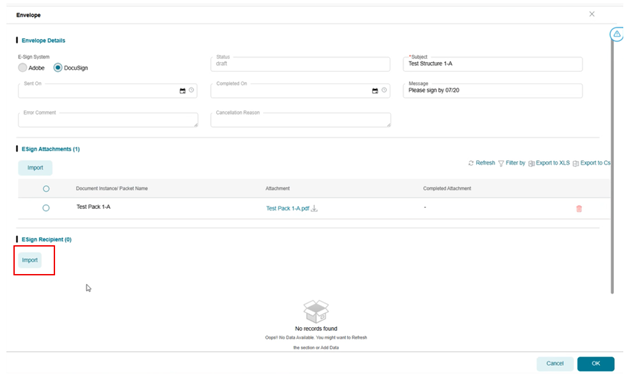

Once you click Add Envelope a Details screen will show:

• Add Subject and Message as needed for the email.

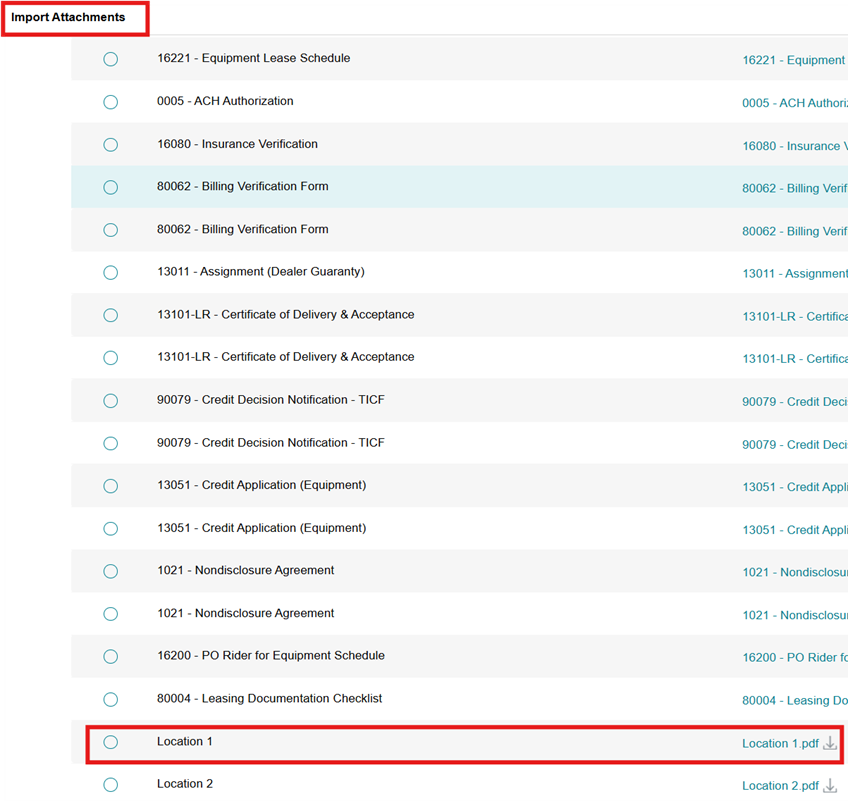

• Attach documents using ESign Attachments, click Import.

• Import Attachments allows you to select your packet for Docusign. A screen will pop up showing several documents.

o Select the Packet created for this transaction. It may be near the bottom.

o Click the OK button to link the Packet to Docusign.

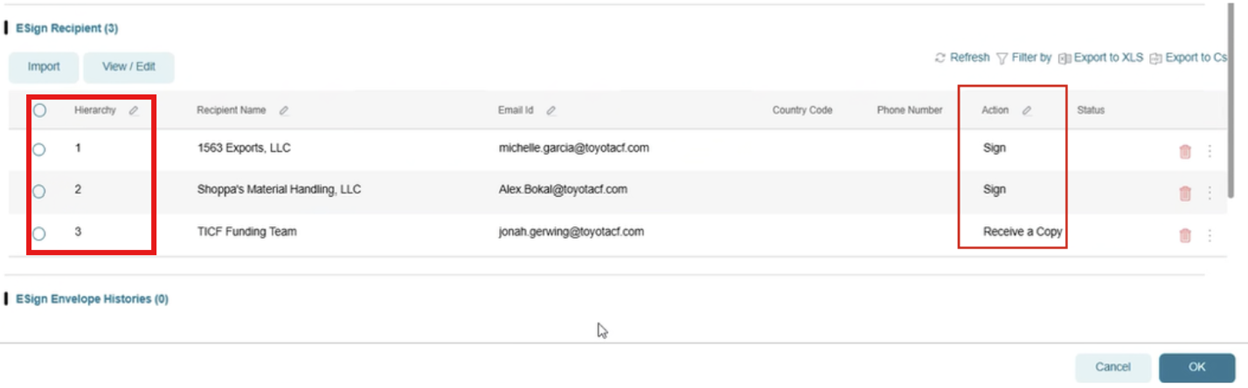

• ESign Recipient: After adding the document Packet proceed to the Esign Recipient section to add contacts for signatures or viewing.

o Select Import Recipients to add a signer or viewer.

• Import Recipients: A pop up screen labeled Import Recipients will list the customer contacts. Choose the person that will be executing the documents for the customer and the dealership Click Ok

o NOTE: If a Contact is not listed on customer record a Service Request will need to be submitted before DocuSign can be sent so that TICF can add the customer contact to the customer record.

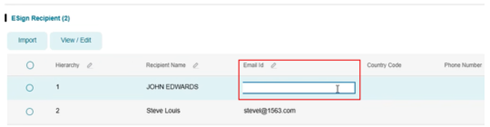

• Editing Recipients Information: If the customer who needs to sign the documents is not listed in your recipient list, there are two ways to update the information.

o Edit in Place: Columns with a pencil icon can be edited directly.

o View/ Edit Button: Use the View/ Edit button to open a separate page where you can update all recipients details at once.

o Note: Recipients email addresses can be edited by clicking the email address as shown below.

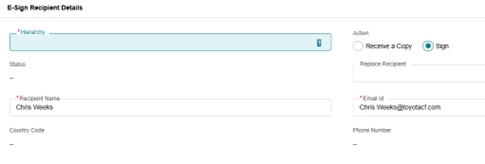

• Other Edit Functions: Within the E-Sign Recipient section you can also

o Set Signature Order: Choose the hierarchy in which the customers will sign the documents.

o Select Action Type: Decide whether a customer will sign the documents or receive a copy only.

• After completing these items Select OK to proceed.

• Verify that all of your information or edits are correct.

• Select the Document Packet, use the radio button next to the correct packet.

• Send Envelope: Click Send Envelope at the bottom of the screen.

• Complete in Docusign: The system will redirect you to Docusign. Within Docusign, add the required fields (signatures, titles and dates) in the appropriate areas of each document.

Funding – Submitting your Funding Package and Takedown

Once your equipment is delivered and you have all executed and supporting documents ready for upload follow these steps to submit your funding package and complete the Takedown process.

• Gather all required documents:

o Make sure you have all executed documents either physical or via DocuSign and all supporting documents (Dealer invoices, Funding Checklist, etc.)

o If using Odessa DocuSign: Executed documents will automatically return to the system.

o You will still upload any relevant supporting documents following the process below.

o If using External Docusign or physical documents you must manually upload these into the system as follows.

• Upload your Funding Package:

o Go to the Document List on the right hand side of screen.

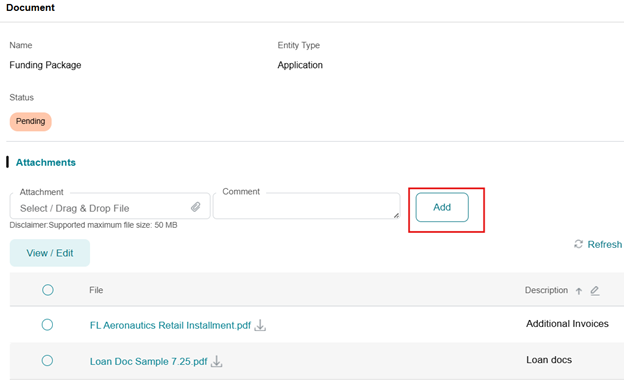

o Scroll to the bottom of the list to the Funding Package item.

o Right click on Funding Package and Select View/Edit.

o A secondary screen will appear allowing you to add documents. Drag and Drop your documents into the upload area.

o Once all documents are uploaded, click OK and return to the main Document List screen

o Submit the Package: Select Submit This is a crucial step to ensure that you have saved your uploaded documents to the system.

• Once all executed documents are uploaded and everything is finalized you will commence the Initiate and Complete Takedown process. This process moves the documents to our Funding team to commence the deal.

Initiate and Complete Take Down Process

Use this step only when you know that the package is ready for funding. This locks the deal into the system and limits changes in the Partner Portal.

• The final 2 steps to send the documents to the Funding Department are Initiate Takedown and Complete Takedown.

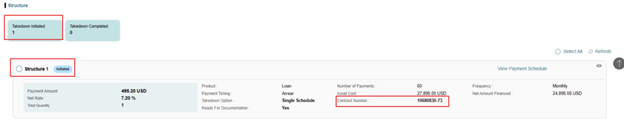

• Select Final Review and in the Structure section locate the Takedown line.

o Hover over or click on the “No” checkbox – a box will appear for you to check.

o This changes the Takedown status from No to Yes

o Select Initiate Takedown in the bottom right.

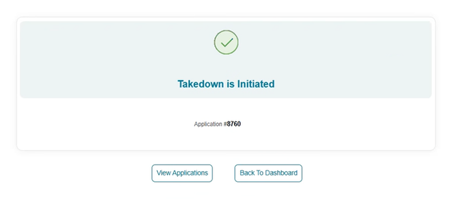

o A slide in panel will reflect the Takedown is Initiated successfully.

o Contract Number: When you close the takedown box, you will now see that the lease/loan has a contract number.

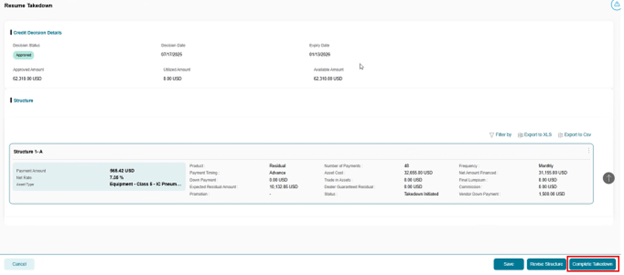

Complete the Takedown Process

• At the Homepage you will begin the Complete Takedown process.

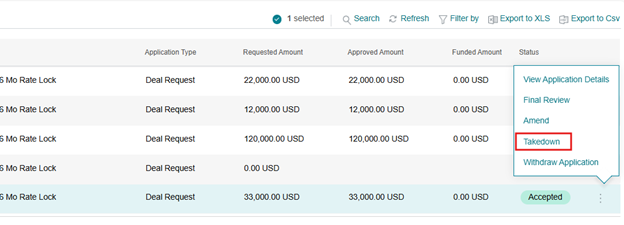

• View Application and find the application number you are ready to complete.

o Right click on the Application line or use the three edit buttons on the right to select Takedown.

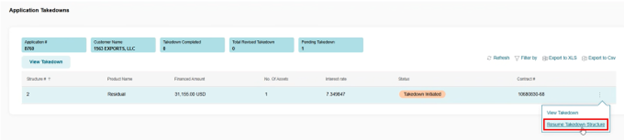

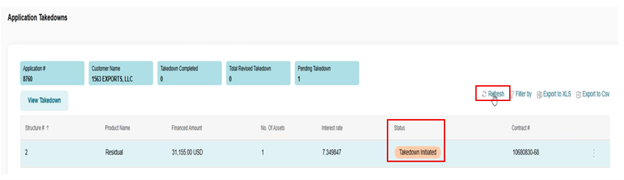

• Once Takedown is executed your deal structure will show on the screen. Using the three-edit button select Resume Takedown Structure.

• The summary page will appear, and you will select Complete Takedown for this transaction.

• Initially the status will reflect Takedown Initiated. If you select Refresh you will see a change in status to Takedown Completed.

• Completed: Success! Once Takedown Completed shows the documents are in the Funding Team’s queue for dealer funding.

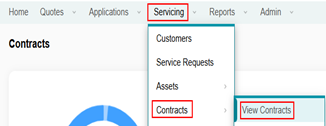

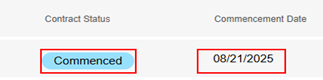

Note: To confirm the contract has been commenced:

• Click on Servicing

• Click on Contracts

• Click View Contracts

o The contract status will reflect Commenced as shown below

Held Deal:

If you have a Held Transaction where the funding team needs additional documentation (updated invoice, correction letter, etc.) it is easy to add any supplemental documents within the TICF Partner Portal. The upload process is the same as the funding document upload.

• Find your application that needs documents on the Homepage and use the three edit buttons to select Final Review.

o You will get a pop up stating that the deal is locked in Takedown mode.

o Select OK for read-only mode.

o Return to the Document List Menu and select the Funding Package.

o Click View/Edit and your Document screen will appear allowing you to add needed attachments via Drag and Drop. You can add a description as well using the pencil to edit that line.

• Select Ok to return to the main summary screen.

• Click Submit to send the documents to the funding team. This is a crucial step to ensure that we receive the documents.

• Documents will now be back in a queue for funding.

Training Video Resources

Key Terms

| Key Term | Definition |

|---|---|

| Shutdown Communication | Communicate last day of app submittal, down time and possibly delay in funding times. Stress the need to get apps in early, understand that funding will come very soon after launch on pending deals. Customer: May have delay in billing and received “catch up” invoices. |

| Funding Remittance Doc/Payment Advice | Remittance Form for ACH is changing and at go live the new form will have less information than current. Screen shots for comparison will be giving. |

| Flex Lease | The Flex Lease identification and documentation will become a manual process. Odessa does not have the fields to accommodate the multiple terms of a Flex Lease as TC3 does. |

| Migrated Data | Migrating over 6 months of approved applications, make them aware that some program. |

| Irregular, Deferred Contracts | Irregular, Deferred contracts are not migrating correctly. We are working on a solution to bring over the information in a more generic form. |

| Lease Payoffs | This is a new feature that is an enhancement and we will show the steps in the training guide. The dealer has 3 ways to request a payoff and 2 of those processes are built into Odessa and more automated. |

| Billing Lead Time | Both dealer and customer need to know that standard invoice lead time is being reduced from 25 days to 17 days to improve late charge billing. |

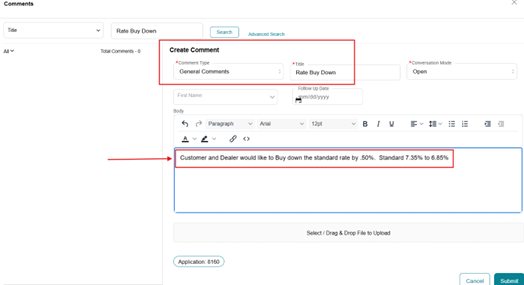

| Buydowns | Buydowns are not available in Odessa, dealer will have to request a buydown from credit. |

| TICF to Remit Tax | For Lease contracts where Taxes are upfront, TICF to Remit is the only remittance option available. Dealers will no longer be able to select Dealer to Remit |

Key Differences

Key Differences between TC3 and the NEW TICF Dealer Portal

This section highlights key differences between TICF’s old system, TC3, and our new Dealer Portal. If you currently use or are familiar with TC3, this section below will be helpful for you to know what processes will be slightly different in our new system.

- Amend Function: The New Dealer Portal introduces a new Amend process for making changes to deals after approval. Unlike TC3, the new Dealer Portal routes all amendments through credit. Some changes will auto-approve, but financial ones require manual review.

- Equipment Schedule – MLA Date: The new Dealer Portal doesn’t have a field for the Master Lease Agreement (MLA) date, which TC3 did have a field for. In the new Dealer Portal, you will need to manually add it using DocuSign or handwriting. We are actively working on this issue as a future enhancement post-launch.

- Master Lease Creation: Master Lease creation is now handled at the funding stage using the Dealer Portal’s Master Agreement module. This change centralizes MLA info at the customer level and simplifies tracking.

- Application Submittal: You won’t see a credit analyst listed on your transaction anymore. The new Dealer Portal uses a queue system for credit decisions, which should improve consistency. You will still have access to your credit

analyst, and we will continue sharing contact lists with you to reach us for any questions or concerns. - Shutdown Communication: During the cutover period when we will sunset TC3 and move to the new Dealer Portal, expect delays in approvals and funding. Submit applications early to avoid disruptions. Customers may receive invoices due to billing delays.

- Funding Remittance Document: The new ACH remittance form in the Dealer Portal is simpler and includes VIN/

SN and manufacturer info. However, the form does not contain customer names or markup breakdowns. We are

actively working on this issue as a future enhancement post-launch. - Migrated Data: Most approved applications from the past six months are migrating from TC3 to the new Dealer Portal, but some may need updates or require re-submission. Please double-check your deals to ensure accuracy.

- Lease Payoffs: You can request payoffs via Quick Action or Servicing sections in the new Dealer Portal or still use the email inbox like you do today. Customers will use service tickets. Lease payoffs are not visible to customers yet in the new TICF Customer Portal, but loan paydowns may be soon available as a future Customer Portal enhancement.

- Billing Lead Time: Invoice lead time is reduced from 25 to 17 days to improve late charge billing. This change is system-driven and helps streamline operations.

- Service Requests: Dealers will now use Service Tickets for changes, questions, and asset additions. This replaces email-based requests and allows tracking of status and timing.

- New Location Approval: All new locations must be approved before contracting. If you add a new address during documentation, use the Amend process. The TICF Dealer Portal integrates with Vertex for accurate tax calculations, showing whether tax is upfront or on payments.

- Loan Contracts – Multiple Units: The new Dealer Portal allows multiple units on an application but only one unit per loan contract. If needed, TICF funding can manually create a multi-unit contract. Contact funding for assistance.

- Credit Decision Notifications: All dealership contacts listed for Originations will now receive approval/decline emails, not just the submitter. This is a new feature in the Dealer Portal.

- Applications by Program: Applications must be submitted by program type (New Hino, Used Trucks, Non-Hino). TC3 allowed mixed assets, but the Dealer Portal requires separation. While this adds steps, it aligns with document processing.

- Buydowns: In the new Dealer Portal, buydowns are no longer available. Instead, dealers must request them from the credit team.

- TICF to Remit Tax: For lease contracts with upfront taxes, TICF will remit taxes and dealers can no longer choose to remit. This ensures compliance and removes dealer liability.

- Splitting Structure: Splitting structures works differently in the Dealer Portal. Once split, units can’t be rejoined. If address changes are involved, a new application may be needed.

Key Dates & Deadlines

KEY DATES AND DEADLINES

- October 31, 2025: Final day to process any TQ Wholesale payoffs or Wholesale Obligations (Retail Offset). Please ensure that all Wholesale payoffs, obligations, and related transactions are submitted by October 31 to avoid delays.

- Legacy loan and retail installment contracts will not be accepted for funding if not funded and booked by October 31, 2025. After October 31, 2025, new contracts will need to be utilized. This applies for any in-flight loans approved but not booked by October 31, 2025.

- Credit Apps – Submit by 1:00 pm, CT on October 31, 2025. All credit applications must be submitted in TC3 on October 31 by 1:00 pm, CT. Applications that are not approved by the end of the day on October 31 will not be migrated to the new system. However, Hino dealers can continue to submit applications via email (TICF_Credit_SM@toyotacf.com) for credit review during the shutdown period. We will not be able to fund deals from November 1 through November 6, 2025.

- Completed Funding Packages – Submit by Noon CT on October 31, 2025. All completed funding packages must be submitted in TC3 on October 31 by Noon CT. All funding packages not received by this date/time will need to be submitted through the new Dealer Portal available beginning November 7.

- October 31, 2025: The last day to process Dealer or Customer Payoffs on the retail side is October 31. All payoffs received after October 31 will be processed in the new Dealer Portal after November 7.

SYSTEM INTERRUPTIONS DURING CUTOVER

- TICF systems will be down during Cutover. On October 31, TC3 and SAP will shut down at 5:00 pm, CT. On November 7, all legacy systems will sunset and convert over to our new Operating system including a new Dealer and Customer Portal. There will be no processing of business during this cutover period.

- TICF will not be able to process any transfers of leases or loans between October 31 and November 6.

- Title and UCC releases may be delayed between October 31 and November 7 if payments are received during the cutover dates for dealers and customers. The customer contract transferred to the new Dealer Portal must be terminated before title releases can be completed.

- Credit and Funding decisions will be temporarily unavailable due to system limitations on November 4, November 5, and November 6. However, Hino dealers can continue to submit credit applications via email (TICF_Credit_SM@toyotacf.com) for credit review during the shutdown period. We will not be able to fund deals from November 1 through November 6, 2025.

More Help & FAQs

Coming soon…

Feedback Form

Contact US

Don’t ever hesitate to get in touch with us for any questions or concerns: HinoDealerPortal@toyotacf.com

Contact Us

© Hino Motors Manufacturing U.S.A., Inc.